Table of Contents

What Is Reclassification?

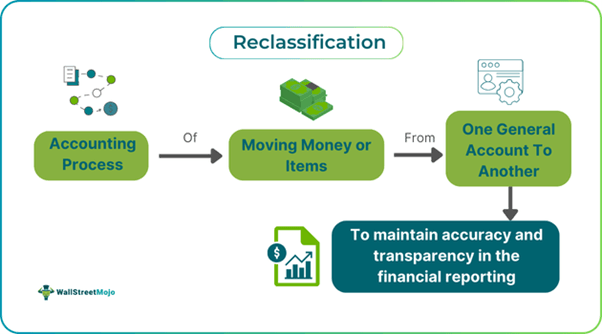

Reclassification in accounting refers to the procedure of shifting financial amounts from one ledger account to the other under the general ledger. Such adjustment helps maintain accuracy, transparency, comparability, and clarity in financial statements and ensures adherence to accounting standards like Generally Accepted Accounting Principles (GAAP).

Stakeholders use it to better understand a company's financial performance. It also helps them make informed decisions by giving the correct status of the company's profitability and operational efficiency. It also depicts transferring notes payable from long-term liability to a current liability account with a maturity period of less than one year.

Key Takeaways

- In accounting, reclassification is the process of moving money or items from one general ledger account to another under the general ledger for proper financial reporting and presentation.

- Such adjustments enable compliance with accounting rules, such as GAAP or IFRS, by improving financial statements' correctness, transparency, comparability, and clarity.

- It is vital for decision-making, consistency, transparency, and adherence to accounting standards. It can modify financial measures and impact analysis and require robust internal controls.

- It helps ensure accurate, correct financial reporting and streamline assets and liabilities according to their appropriate categories, but it can also result in mistrust or confusion if changes are not justified or explained clearly to stakeholders.

Reclassification In Accounting Explained

The reclassification definition in accounting states it as the method of moving financial amounts or items from one general ledger account to the other. Such shifting helps in an accurate reflection of compliance with relevant accounting standards and proper classification of items on financial statements. Through this process, the balances or transactions are evaluated first and are then reallocated to the right accounts, reflecting the changes made in journal entries.

Reclassification plays a critical role in financial reporting as it maintains clarity and integrity in financial data. In this way, it ensures financial statements align with principles of accounting and improves comparability of financial statements in the long term. As a result, it helps stakeholders make wiser decisions by accurately valuing their financial position. Reclassification should ensure improved accuracy in reporting financials and must follow regulatory requirements.

If the assets or amounts or items are misclassified, then it can result in the wrong presentation of financial health that significantly impacts market performance and investor trust. It has become useful in presenting a true and vivid picture of the operations of a company, catalyzing better evaluation and comprehension of financial productivity. Through net reclassification improvement (NRI), the efficiency of new models in reclassifying individuals into risk types is examined in comparison to the previous models. Dividend reclassification helps in the adjustment of dividend payments as per changes in the earnings of a company or its financial strategy.

Reclassification affects investors' and stakeholders' market perceptions and investment decisions. It enables investors to gauge opportunities and risks effectively, setting up a more stable economic environment.

Key Principles

Reclassification works on certain principles, which have been listed below:

- Materiality: All financial data has to be reclassified according to its significance to users' decision-making, thereby accounting for its nature and impact on financial reports.

- Consistency: Firms should apply uniform accounting practices and policies while reclassifying to retain comparability of financial information over time.

- Disclosure Requirements: Sufficient disclosures remain essential, containing the detailed reason for reclassifying, effects on financial ratios, and mention of amounts involved, guaranteeing transparency.

- Financial Ratios and Analysis Impact: The transfer of amounts or items from one account to another modifies the structure of key financial measures like solvency ratios, probability, and liquidity, affecting financial analysis.

- Accounting Standards and Regulatory Frameworks: All reclassifying must adhere to relevant guidelines specified under frameworks, such as GAAP and International Financial Reporting Standards (IFRS), which guide presentation, disclosures, and executions.

- Audit Considerations and Internal Control: Robust internal controls and audit processes become vital for ensuring adherence to standards, proper authorization, and correct reclassification.

Examples

Let us use a few instances to understand the topic.

Example #1

An online article published on February 21, 2023, discusses how the Internal Revenue Service (IRS) recategorization of a few crossover vehicles to make them eligible for credit for clean vehicles. In short, this reclassification of vehicles would help prove their worth in obtaining the credits.

Earlier, there were vehicles with a manufacturer's suggested retail price (MSRP) cap limited to $55,000 and were categorized as other vehicles. However, as per the updated model, these vehicle categories were now classified as SUVs with increased value worth $80,000.

This increased MSRP cap has transformed the automotive market, and purchasers of all vehicle models that fall under the new category must contact dealers for revised seller reports so that they can claim the applicable credit.

Example #2

Let us assume that Greeney, a green energy firm located in Old York City, commits to reclassifying its investment portfolio. In the beginning, the company classifies its $5 million investment in Company A as a long-term investment asset. But, because of market changes, Greeny now anticipates selling the investment within the following year.

As a result, its finance team recategorizes the investment as a current asset. The modification is embedded in financial reports, transferring the investment from long-term to current assets. Therefore, Greeney's balance sheet shows a more realistic picture of its short-term financial positions and liquidity. In this manner, stakeholders get to know the true financial status and make wise decisions about investing in the company's future stakes.

Advantages And Disadvantages

It has certain pros and cons:

| Advantages | Disadvantages |

|---|---|

| Helps in accurate, correct financial reporting, streamlining assets and liabilities as per the appropriate categories | Results in mistrust or confusion in case of changes not justified or explained clearly to stakeholders. |

| Increases openness and adherence to updated accounting standards. | Complexity and administrative workload increase by frequent reclassification in financial records. |

| Helps improve financial evaluation by representing the real nature of transactions. | It may affect the financial ratios that may mislead creditors or investors. |

| Allows avoidance of potential penalties and better tax reporting | Cause incurring additional review costs and audits to ascertain accuracy. |

| Presents a clear financial picture supporting management's wise decision-making. | Unless standardized throughout the reporting duration, it can cause possible irregularities. |

| Facilitates in alignment of financial statements as per international accounting practices. | It can produce challenges concerning financial performance over time. |