Table of Contents

What Is Regulation S-P?

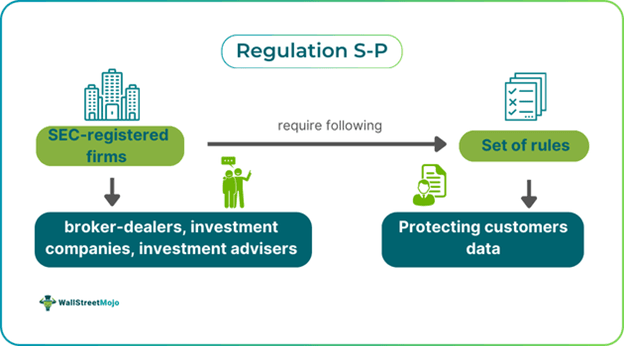

Regulation S-P refers to the requirements whereby registered financial institutions must abide by a series of rules that govern the use of consumers' nonpublic personal information. The United States Securities and Exchange Commission (SEC) mentions these guidelines to put restrictions on brokers and dealers, investment companies, funding portals, advisors, and transfer agents when it comes to using or protecting customer records and information.

SEC Regulation S-P requires firms to have written policies and rules that address the protection of customer data and records. It highlights the importance of the privacy of consumer financial information and safeguarding customer information. The SEC keeps amending this set of rules to enhance customer protection and facilitate the use of technology in the proper disposal of consumer reports and handling of corresponding risks that come with the adoption of this regulation.

Key Takeaways

- Regulation S-P refers to the SEC's requirements that financial firms follow rules and policies, ensuring customer data protection and proper use of nonpublic information.

- The SEC first adopted this regulation in 2000, and since then, it has been perpetually amending the rules to meet emerging requirements to control data breaches.

- The key amendments of regulation S-P focus on the incident response program, notice requirement, annual privacy notice with exceptions, and expanded scope of information and recordkeeping.

- Regulation S-P benefits financial market customers by promoting the protection and safeguarding of their critical information, login details, and assets.

Regulation S-P Explained

Regulation S-P is a collection of rules set by the SEC and adopted in 2000 with continuous amendments in place to ensure having new regulations and policies for a better framework of information access, authority and usage. These requirements came following the enactment of the Gramm-Leach-Bliley Act, which was introduced in 1999, making it mandatory for firms to unveil their information-sharing policies, thereby assuring customers of proper handling of their sensitive data. In addition, it can also be seen as an adoption pursuant to the Fair and Accurate Credit Transactions Act of 2003 ("FACT Act").

Every customer, from a retail investor to a high net-worth individual, shares some crucial personal details, information, and other credentials with institutions, advisors, brokers, dealers, and even agents when participating in financial markets for trading and making investments. Regulation S-P ensures that every entity follows and complies with these rules and amendments, protecting and safeguarding customers' access and use of nonpublic information and critical private data. The only condition is that these firms must be registered with the SEC.

As per this regulation, firms must have policies addressing customer information protection and make customers aware of their rights, especially today when trading and investments are made via web-based platforms. Firms are well informed about the variety of ways customer data can be compromised, given the potential risks involved with unauthorized access, stealing available assets, or misuse of the account. In case the regulation S-P gets violated, customers have the liberty to immediately reach out to the SEC and Financial Industry Regulatory Authority (FINRA).

Compliance Requirements

When it comes to following regulations, there are a number of requirements that individuals and entities must comply with. The final amendments provide a new set of compliance requirements for regulation S-P. The covered institutions must update their existing policies.

Let us check out the requirements that financial institutions need to abide by in case of regulation S-P:

- It dictates that broker-dealers, registered advisors, investment firms, funding portals, transfer agents, and all other covered institutions comply with the new amendments.

- All covered institutions and entities must adopt written policies and procedures to protect and safeguard customer data, private information, and other credentials.

- All covered institutions must adequately dispose of the consumer report information.

- Regulation S-P highlights the requirements of implementing privacy policy notices and informing the customer of any change in the regulations on time.

- The institutions must ensure the imposition of their policies and laws.

- In some cases, compliance requirements are parallel to state data breach laws.

- Regulation S-P, through its compliance requirements, does not alter, affect, or supersede any state law offering greater protection than regulation S-P itself.

Amendments

Since the enactment of this regulation in 2000, the SEC has continuously amended the requirements that firms must fulfill. This is due to the emerging and increasing risks associated with customer data or information sharing. The regulation requirements for the financial institution change based on the form of protection required.

The latest regulation S-P changes or amendments focused on some specific areas, which have been discussed below:

- Incident response program: The final rule amends that all covered members and institutions must abide by the drafted policies and procedures designed to detect, respond to, and recover any form of unauthorized access or use of customer information. This includes assessing the incident scope and taking appropriate actions to prevent it.

- Notification requirement: This amendment states that covered institutions must notify any instance of unauthorized access or use of customer information to affected individuals with proper details. Notice will not be required if the incident is not likely to cause customer inconvenience. Again, the notice must be given no later than 30 days after the institution becomes aware of the unauthorized access or use.

- Service providers: This amendment focuses on covered institutions extending their rules and regulations to start monitoring and surveillance of service providers. The institutions must specify provisions regarding privacy and data security standards in their agreements with service providers.

- Expanded scope of information: This amendment of the final rule expands the scope of information, which runs parallel to the information protected under the safeguard and disposal rule, by introducing a new term: customer information.

- Recordkeeping: This states that the covered institutions must maintain a list of books and written records documenting compliance with the disposal and safeguard rule and update them as necessary.

- Annual privacy notice delivery: The regulation states that institutions must provide annual privacy notices to all customers, but with exceptions. They are not required to deliver these regulation S-P privacy notices if the institution has not made any material changes in its policies and shall only provide nonpublic information to third parties when they can perform services on behalf of the covered institution.

Importance

As customers' sharing of personal data with a platform reflects their level of trust in the platform or firms, it becomes the latter's responsibility to ensure they provide a secure information-sharing interface. This is where the regulation S-P comes in.

The importance of regulation S-P is as follows:

- It addresses the treatment of customer's privacy and data protection.

- It applies to all market entities and participants, including brokers, dealers, agents, and investment companies, to ensure the safety of customer data records.

- The regulation favors market customers when it comes to safeguarding their data and privacy rights.

- Regulation S-P also protects customer data against any security hazards, anticipated threats, or breaches of data integrity.

- The regulation also dictates the process and practices in case a customer's data or information is compromised.