Table of Contents

What Is High Finance?

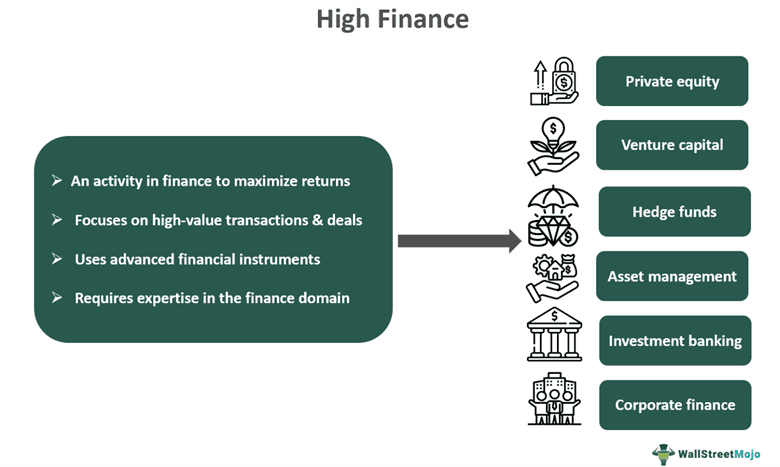

High Finance is a term used to describe complex financial activities, transactions, and strategies that involve significant sums of money, advanced financial instruments, and a high level of expertise in financial markets and investment strategy. One of the central goals of high finance is to generate substantial returns on investment.

It plays a crucial role in the functioning of modern economies and financial systems. Its importance stems from its contributions to economic growth, efficient allocation of resources, risk management, and innovation. It facilitates the flow of capital across international borders, contributing to global economic integration. Investment banking, private equity, and venture capital, among others, fall under the purview of high finance.

Key Takeaways

- High finance refers to intricate and advanced financial activities undertaken by specialized institutions and professionals involving substantial sums of money, complex financial instruments, and sophisticated strategies.

- It encompasses sectors like investment banking, hedge funds, and derivatives trading, often employing technology, mathematical models,

- and innovation to maximize returns, manage risk, and shape financial markets.

- While it contributes significantly to economic growth, innovation, and capital allocation,

- it also poses risks and challenges that need to be carefully managed through responsible business practices, effective regulation, and ethical considerations.

High Finance Explained

High finance refers to the advanced and intricate activities undertaken within the financial industry that involve substantial amounts of capital, varied financial instruments, and specific expertise levels. It represents the highest form of financial sophistication and complexity achievable. It is typically undertaken by large financial institutions, investment banks, hedge funds, and other elite players in the field. High finance revolves around strategies designed to maximize returns, manage risk, and exploit opportunities across a wide range of financial markets and instruments.

This domain encompasses various sectors, including investment banking, where experts advise on mergers, acquisitions, and capital-raising activities for corporations. Hedge funds, which employ complex trading strategies to achieve high returns, are also part of such enterprises. Private equity, where investors take direct stakes in companies, often restructuring them for profit, is another area where one can see high finance at work. For instance, high finance loans are known to fund mergers and acquisitions, leveraged buyouts, etc.

It also extends to the trading of derivatives and other advanced financial products that employ mathematical models and algorithmic trading techniques. Using cutting-edge technology and quantitative analysis is crucial to the success of these endeavors. Financial professionals engage in nuanced risk management, exploring novel ways to diversify portfolios and optimize investments. However, these innovations are not without grave concerns, such as the potential for market manipulation and risks that could impact the stability of the overall financial system in an economy.

The concept of high finance also raises questions about fairness and equity. Critics argue that complex financial instruments and strategies can result in gains for financial institutions while exposing their clients and investors to disproportionate risks. This is exemplified in cases like the student debt issue, where financial institutions profit from interest payments on loans without adequately addressing the broader social implications and costs to stakeholders.

It can be argued that the use of such financial instruments can result in unethical practices going undetected for a considerable period of time. Since most financial market participants are unfamiliar with the investment and financial planning associated with instruments of high finance, it is nearly impossible for stakeholders, clients, or other participants to identify underhanded financial dealings. Due to this, stringent financial regulations, banking rules, and corporate governance that nip unethical or corrupt practices in the bud are needed.

Examples

Let us study some examples to delve deeper into the concept and see how these deals work.

Example #1

Suppose a global hedge fund named Stonehaven Capital identifies an opportunity to capitalize upon a potential merger between two leading pharmaceutical companies, PharmaTech and BioHealth.

Recognizing the complexities of the deal and the need for swift execution, Stonehaven Capital employs advanced algorithmic trading strategies to accumulate shares in both companies discreetly while analyzing market sentiment in real time. Using leverage, derivatives, and options contracts, Stonehaven Capital hedges against market volatility and potential risks.

As news of the impending merger breaks, the fund's strategic positions yield substantial profits as share prices soar. Stonehaven Capital's mastery of algorithmic trading and sophisticated financial instruments results in considerable gains while minimizing exposure to market uncertainties. This shows the intricate nature and potential profitability offered by high finance activities.

Example #2

A May 2024 New America post discusses private equity, which is a form of high finance, making inroads into the field of childcare funding in the US. The post states that the relatively neglected area of childcare in the US has grabbed the attention of private equity investors, who wish to execute turnaround strategies, make money, and sell these enterprises for profit. Consider the following statistics that explain the scenario in monetary terms:

- Private equity firms own (capacity-wise) 8 of the 11 largest US childcare chains

- They control around 10 to 12 percent of the licensed childcare market in the US

Whether these initiatives will improve US childcare facilities is a question that does not have any satisfactory answers. This situation has all the hallmarks of a high-finance initiative that will likely bring about many adverse outcomes, particularly with respect to the affordability and quality of childcare in the US.

This is a classic example of high finance, where investors aim to capitalize upon attractive money-making opportunities. Though the possibility that this might contribute to societal development exists, it could also result in a blatant disregard for the needs of society, including social upliftment goals.

Significance

The significance of high finance lies in its multifaceted contributions to the global economy, financial markets, and societal development. Some key aspects of its significance include:

- Capital Allocation and Economic Growth: High finance plays a critical role in efficiently allocating capital to businesses, projects, and innovations that have the potential to drive economic growth and job creation. By channeling resources to their most productive uses, high finance helps stimulate economic development and innovation.

- Market Efficiency and Liquidity: These activities contribute to market efficiency by facilitating price discovery, enabling quick and efficient trading, and providing liquidity to financial markets. This ensures that assets are fairly priced and easily tradable, promoting overall market stability.

- Innovation and Financial Products: It drives financial innovation by creating new instruments, strategies, and products that cater to the specific needs of investors and businesses. These innovations can enhance risk management, offer worthwhile investment opportunities, and improve access to capital for a wide range of stakeholders.

- Risk Management and Hedging: It offers advanced risk management tools that help businesses and investors mitigate various financial risks, such as market volatility, interest rate fluctuations, and currency exchange rate changes. This contributes to financial stability and reduces the potential impact of adverse market conditions.

- Global Integration: High finance connects financial markets across borders, facilitating the flow of capital, investment, and trade on a global scale. This integration supports international economic cooperation and enables portfolio diversification for investors.

Impact

The impact of high finance is wide-ranging and can have both positive and negative consequences on economies, financial markets, and society. Here are some key impacts of high finance:

#1 - Positive Effects

- Economic Growth: It facilitates the allocation of capital to productive projects and businesses, driving economic growth, job creation, and innovation. It provides the necessary funding for businesses to expand, invest in research and development, and contribute to overall economic development.

- Financial Innovation: High finance encourages the development of new financial products, instruments, and strategies that enhance risk management, investment opportunities, and market efficiency. These innovations can help investors achieve specific financial goals and improve overall market functioning.

- Market Liquidity: These activities contribute to market liquidity by providing the means for easy buying and selling of assets. This ensures that markets remain orderly and that investors can access their funds when needed.

#2 - Negative Effects

- Inequality: It can exacerbate income and wealth inequality, as the benefits of financial activities often accrue to those who are already wealthy and have access to sophisticated investment opportunities.

- Systemic Risk: The complexity and interconnectedness of high finance can contribute to systemic risks that have the potential to destabilize the entire financial system, as witnessed during the 2008 Financial Crisis.

- Market Volatility: Certain high finance activities, such as algorithmic trading and high-frequency trading, can contribute to market volatility and abrupt price fluctuations, making markets more unpredictable.

- Financial fraud and mismanagement: Fraud, manipulation, and financial mismanagement are distinct possibilities due to the complicated nature of financial transactions and deals executed under the ambit of high finance activities.