Table Of Contents

What is Terminal Value Formula?

The terminal value formula helps estimate the value of a business beyond the explicit forecast period. In a DCF model with a five-year free cash flow projections, the terminal value formula = FCFF6 / (WACC – Growth Rate)

Key Takeaways

- The terminal value formula aids in determining a company's worth after a predicted period. The terminal value calculation in a DCF model with five-year free cash flow projections is FCFF6 / (WACC - Growth Rate).

- There are three methods for determining terminal value in DCF valuation: the perpetual growth approach, the exit multiple growth method, and the no-growth perpetuity model.

- Terminal value is crucial for estimating Discounted Cash Flow, accounting for 60%-80% of a company's worth. The growth rates, discount rates, and multiples such as PE, Price to Book, PEG ratio, EV/EBITDA, EV/EBIT, etc., should be considered.

3 Most Common Terminal Value Formulas

In DCF Valuation, there are three ways to find terminal value. they are as follows:-

- Perpetuity Growth Method

- Exit Multiple Growth Method

- No Growth Perpetuity model

#1 - Perpetuity Growth Method

The Perpetual Growth Method is also known as the Gordon Growth Perpetual Model. It is the most preferred method. In this method, the assumption is made that the company's growth will continue, and the return on capital will be more than the cost of capital.

Terminal Value = FCFF6 / (1 + WACC)6 + FCFF7 / (1 + WACC)7 + …..+ Infinity

If we simplify the formula it will be,

Terminal Value = FCFF6 / (WACC – Growth Rate)

FCFF6 can be written as, FCFF6 = FCFF5 * (1 + Growth Rate)

Now, use Formula in the above equation given,

Terminal Value = FCFF5 * (1 + Growth Rate) / (WACC – Growth Rate)

This method is used for mature companies in the market and has stable growth companies Eg. FMCG companies, Automobile companies.

#2 - Exit Multiple Method

Exit Multiple Method is used with assumptions that market multiple bases to value a business. The terminal multiple can be the enterprise value/ EBITDA or enterprise value/EBIT, the usual multiples used in financial valuation. The projected statistic is the relevant statistic projected in the previous year.

Terminal Value = Last Twelve months Terminal Multiple * Projected Statistic

#3 - No Growth Perpetuity Model

No growth perpetuity formula is used in an industry where a lot of competition exists, and the opportunity to earn excess return tends to move to zero. In this formula, the growth rate is equal to zero; this means that the return on investment will be equal to the cost of capital.

Terminal Value = FCFF6 / WACC

Eg. It is useful to calculate the GDP of the country.

Examples

Example #1

If the metal sector is trading at ten times the EV/EBITDA multiple, then the company's terminal value is ten * EBITDA.

Suppose,

- WACC = 10%

- Growth Rate = 4%

- Debit = $100

- Cash = $60

- Number of Shares = 200

Find the per share fair value of the stock using the two proposed terminal value calculation method.

Terminal Value Formula - Explained in Video

Application of Terminal Value Formulas

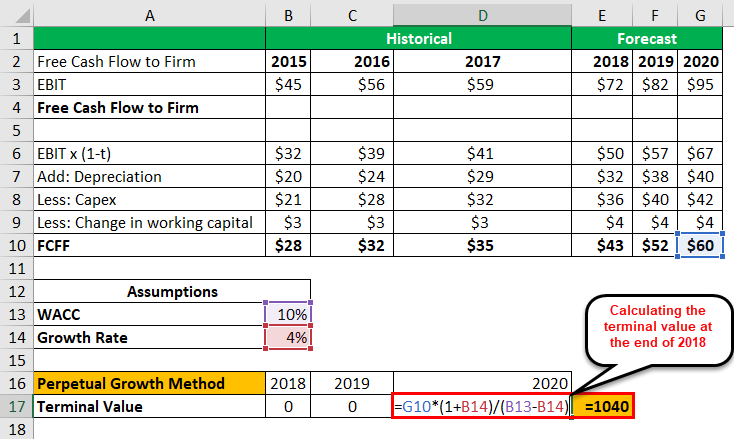

#1 - Terminal Value – Using the Perpetuity Growth Method

Calculate the NPV of the Free Cash Flow to the Firm for the explicit forecast period (2014-2018)

Follow the steps below to find terminal value using the perpetuity growth method:

- Calculate the NPV of the Free Cash Flow to the Firm for the explicit forecast period (2014-2018)

The formula for the Present Value of Explicit FCFF is NPV() function in excel.

$127 is the net present value for the period 2018 to 2020. - Terminal Value calculation (at the end of 2018) using the Perpetuity Growth method

Using the Perpetuity Growth method, Terminal Value will be: 1,040 - Present Value of Explicit FCFF

- Now, Calculate the Enterprise Value and the Share Price

Please note that the Terminal value contribution to enterprise value is 86% in this example. Generally, the contribution is between 80 – and 90%.

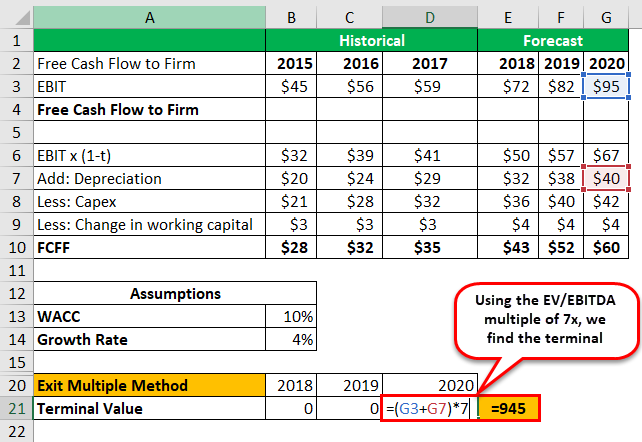

#2 - Terminal Value - Using Exit Multiple Method

- Step #1 – For the explicit forecast period (2018-2020), calculate the Free Cash Flow NPV for the firm. Please refer to the above method, where this step has already been completed.

- Step #2 – Use the multiple exit methods for terminal value calculation of the stock (end of 2018). Let us assume that the average companies in this industry trade at seven times EV / EBITDA multiples. We can use the same multiple to find this stock's terminal value.

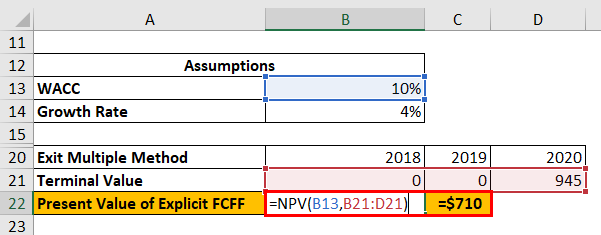

- Step #3 - Calculate the Present Value of Explicit FCFF

- Step #4 - Now, Calculate the Enterprise Value and the Share Price

The terminal value contribution to enterprise value is 80%.

Relevance and Uses

- Use in a financial tool like the Gordon growth method.

- To calculate discounted cash flow examples of the same we have seen above.

- To calculate residual earnings.

Terminal Value is an important concept in estimating Discounted Cash Flow as it accounts for more than 60% – 80% of the total company’s worth. Special attention should be given to assuming the growth rates, discount rate, and multiples like PE, Price to book, PEG ratio, EV/EBITDA, EV/EBIT, etc.

There are some limitations of terminal value in discounted cash flow; if we use exit multiple methods, we are mixing the DCF approach with a relative valuation approach as the exit multiple arrives from the comparable firm. Terminal value contributes more than 75% of the total value; this becomes risky if the value varies significantly, with even a 1% change in growth rate or WACC. Please note growth cannot be greater than the discounted rate. In that case, one cannot apply the Perpetuity growth method.