Table Of Contents

What Is SOTP Valuation (Sum of Parts)?

Some of the parts (SOTP) is the method of valuation of the firm where each of the company's subsidiaries or its business segment is valued separately. Then all of them are added together to arrive at the firm's total value.

Most large companies operate in more than one business. Valuing a diversified company requires separate valuations for each business and the corporate headquarters. This method of valuing a company by parts and then adding them up is known as SOTP or its full form Sum of the Parts valuation and is commonly used in practice by stock market analysts and companies themselves. (Simple :-))

Sum of Parts Valuation (SOTP) simplified

Let us understand the sum of the Parts valuation using an example of a large conglomerate company (ticker MOJO) that operates the following business segments.

SOTP Valuation of MOJO Corp

The common valuation techniques are Relative Valuations, Comparable Acquisition Analysis, and the DCF Analysis. These techniques can be applied to value MOJO Corp; however, before we do so, let us answer the questions below -

Should you apply the Discounted Cash Flow Approach to Value MOJO?

- Yes, you can. However, if you do so, the valuation would be technically INCORRECT.

- Reason - You can use DCF Financial Modeling to value segments like Automobiles, Oil and Gas, Software, and eCommerce. However, Banks are typically valued using the Relative valuation approach (usually Price to Book value) or Residual Income Method.

Should you apply the Relative Valuation approach to value MOJO?

- Yes, you can do so. But do you think a single valuation methodology like PE Ratio, EV/EBITDA, P/CF, Price to Book Value, PEG Ratio, etc. is appropriate to value all the segments? Obviously, this would again be technically INCORRECT.

- Reason - If the E-commerce segment is unprofitable, applying a blanket PE multiple for valuing all segments will not make much sense. Likewise, banks are correctly valued using the Price to Book value approach than the other available multiples.

What is the solution?

The solution is to value the different parts of the business separately and add the values of the different parts of the business together. This is a sum of parts or SOTP valuation.

How do we apply the Sum of Parts valuation in the case of MOJO?

To value a conglomerate like MOJO, one can use different valuation tools to value each segment.

- Automobile Segment Valuation - Automobile Segment could be best valued using EV/EBITDA or PE ratios.

- Oil and Gas Segment Valuation - For Oil and Gas companies, the best approach is to use EV/EBITDA or P/CF or EV/boe (EV/barrels of oil equivalent)

- Software Segment Valuation - We use PE or EV/EBIT multiple to value Software Segment

- Bank Segment Valuation - We generally use P/BV or Residual Income Method to value Banking Sector

- E-commerce Segment - We use EV/Sales to value the E-commerce segment (if the segment is not profitable) or EV/Subscriber or PE multiple

If you are new to Relative valuation methodologies, you can read the following articles to enhance your learning of valuations –

Sum of the Parts Video Explanation

Sum of Parts Valuation (SOTP) Example - ITC

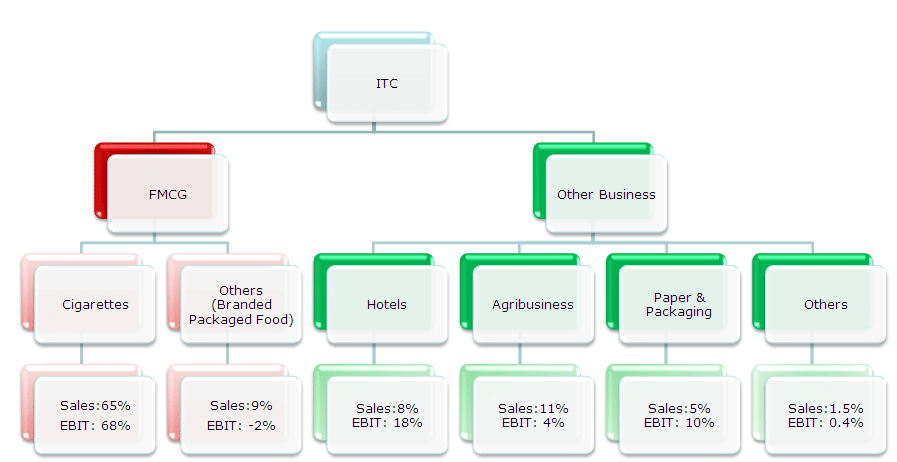

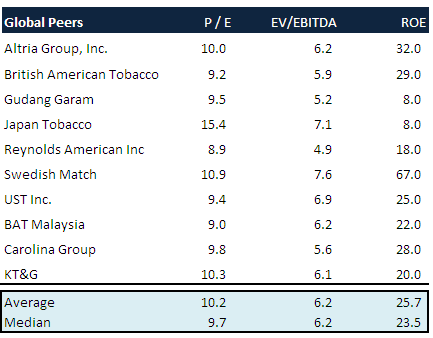

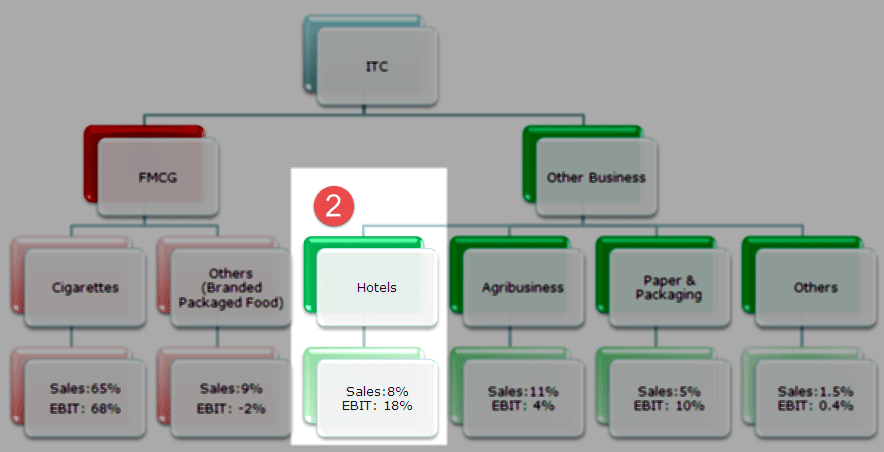

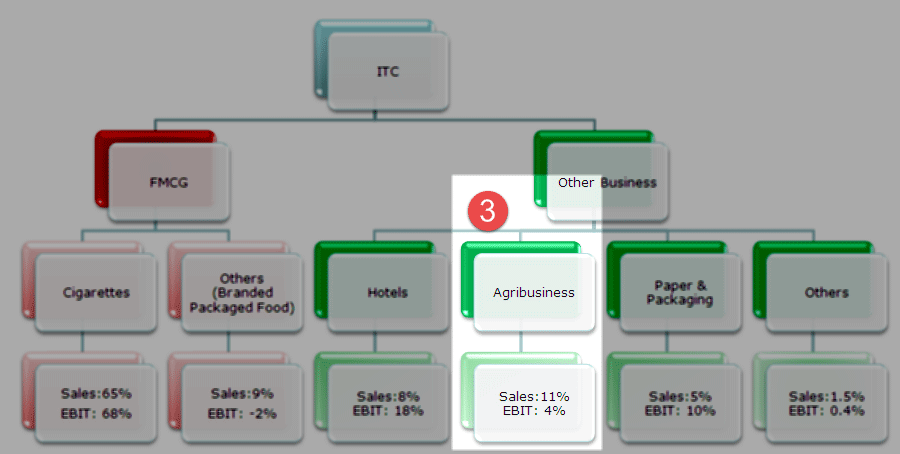

Let us apply SOTP on ITC Ltd, a large conglomerate based in India. ITC has a diversified presence in Cigarettes, Hotels, Paperboards & Specialty Papers, Packaging, Agri-Business, Packaged Foods & Confectionery, Information Technology, Branded Apparel, Personal Care, Stationery, Safety Matches, and other FMCG products.

While ITC is an outstanding market leader in its traditional businesses of Cigarettes, Hotels, Paperboards, Packaging, and Agri-Exports, it is rapidly gaining market share even in its nascent Packaged Foods & Confectionery, Branded Apparel, Personal Care, and Stationery.

As each of ITC's businesses is vastly different from the others in its type, the state of its evolution, and the basic nature of its activity, the challenge for analysts, therefore, lies in fashioning a model that addresses the value for each of its unique businesses and then arrives at a value for the company as a whole.

Below are the segment details of ITC

(p.s. The data taken is from 2008-09 annual reports and does not reflect the current performance of the breakup of ITC Ltd Segments. This case study of ITC valuation should only be used for educational purposes and does not be construe any investment advice)

Let us apply the Sum of Parts - SOTP Valuation approach here

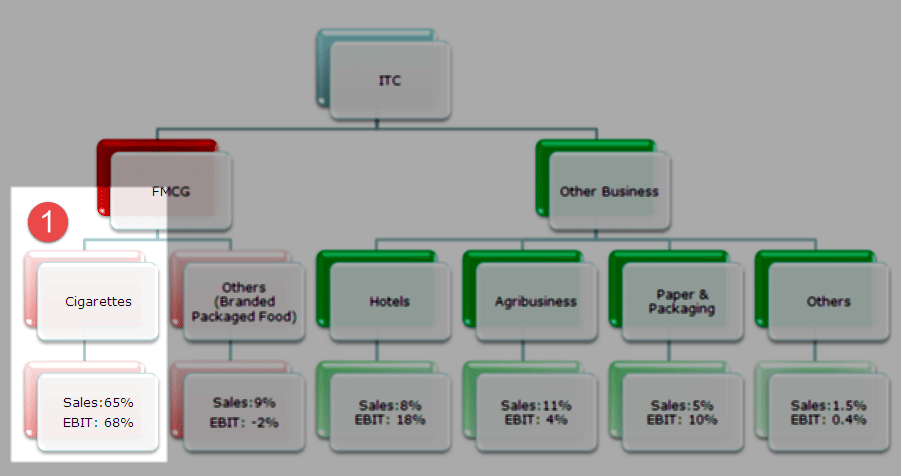

Segment 1 - Cigarette Segment Valuation

A cigarette is the core business of ITC and the major revenue contributor. It contributes more than 65% to the total revenues generated, and 68% of profits are generated by this segment only.

Step 1 - Understand the Key Characteristics of Cigarette Segment

- ITC's monopoly status within the cigarette industry

- ITC's volume growth of 3.7% has been twice that of the industry in the past 15%

- Faster growth considering low cigarette penetration.

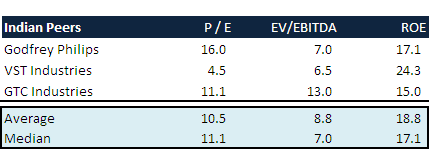

Step 2 - Choosing an appropriate Peer Group - Indian Peers

- Godfrey Philips: Strong player in the middle price segments

- VST Industries: Lower end in the market

- GTC Industries: Lower end in the market

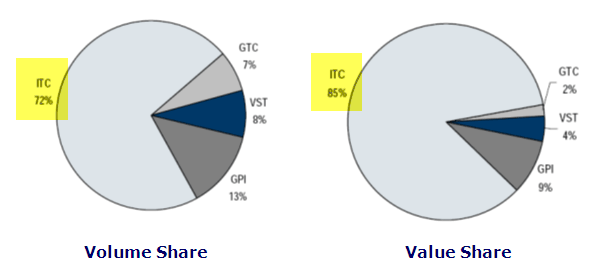

The data below reflects the market share and value share of this segment.

Step 3 - Comparable Company Valuation Analysis for these Indian peers.

Practical Problem in identifying peers - As you can see from the above charts, ITC has a clear monopoly in the Cigarette segment (both volume and value share). So how can we compare the valuation of the ITC segment with the valuation of much smaller peers? With this, we should look for global peers who may be of similar size.

Step 4 - Choosing an appropriate Peer Group - Global Peers

Below is the list of Cigarette Segment global peers and their valuation multiples -

Step 5 - Identifying the Most suitable valuation methodology

The most appropriate valuation multiple for valuing ITC Cigarette Segment is P/E or EV/EBITDA Multiple

Segment 2 - ITC Hotel Segment Valuation

Contributes only 8% to sales but approximately an 18% contribution to EBIT.

Step 1 - Key Characteristics of Hotel Segment

- Asset intensive and has a long gestation period business.

- High Margins

Step 2 - Identify Listed Peers in Hotel Segment

Step 3 - Choose an appropriate valuation multiple

For valuing the hotel segment, the valuation of multiple approaches like Enterprise value/room or PE or EV/EBITDA can be used.

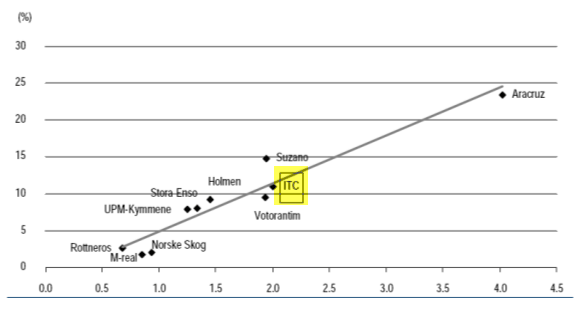

Segment 3 - Paper Segment Valuations

The paper and packaging segment contributes 5% of Sales and 10% to ITC's EBIT.

Step 1 - Note the Key Characteristics

- The paper industry is capital intensive and prone to global cycles.

- Indian Paper industry is fragmented

- Most Indian paper mills are small (98% of mills have a capacity of <50,000 tpa versus the ideal of 300,000 tpa)

- Large mills account for only 33% of output

- Asset intensive and has a long gestation period business

Step 2 - Identify the Key Comparables

No visible listed Indian Peer

Step 3 - Choose the appropriate Valuation Multiple

- Prefer P/BV as this segment is an asset-intensive segment and no visible listed Indian Peer

- Benchmarking P/BV multiple to the average of the Global Peers may be the correct approach

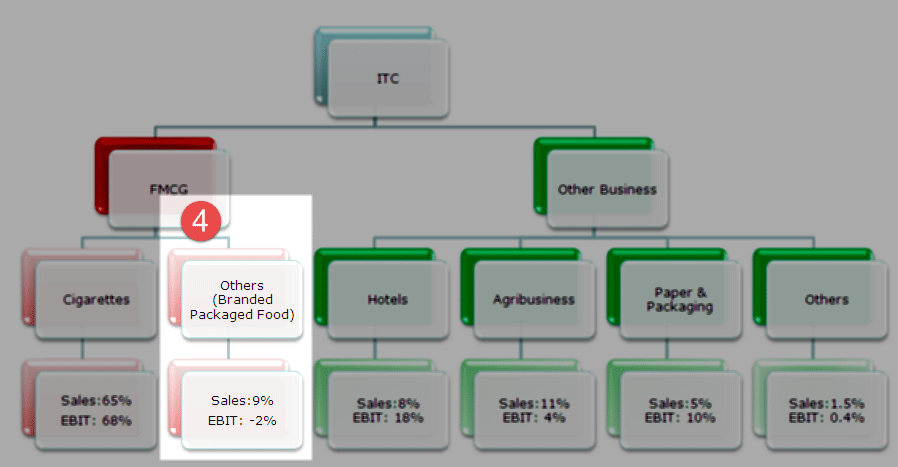

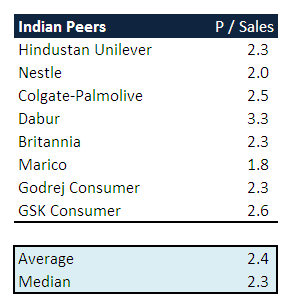

Segment 4 - FMCG (Non-Cigarettes) Segment

FMCG (non-cigarettes) segment contributes 9% of Sales; however, this segment is unprofitable and results in an EBIT margin of -2%.

Step 1 - Identify the Key Characteristics

- Non-profitable, negative earnings

Step 2 - Listed Comparables Operating in the same segment

Step 3 - Choosing the Right Valuation Multiple -

- EV/Sales or P/Sales could be used to value the company

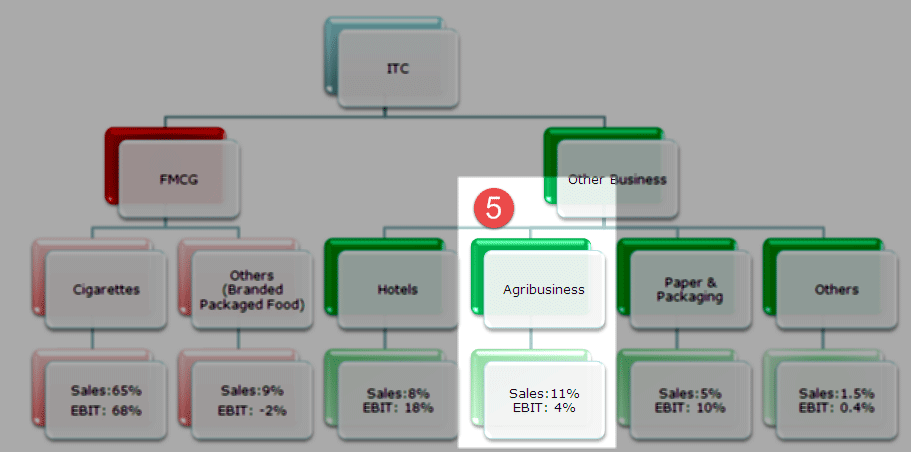

Segment 5 - Agriculture Segment Valuation

The agriculture segment contributes 11% of Sales for ITC and 4% of EBIT.

Step 1 - Identify the Key Characteristics

- The earnings contribution of this business is very small (EBIT contribution is less than 4%)

Step 2 - Choose an appropriate Peer

- No publicly listed peer group available

Step 3 - Choose an appropriate Valuation Multiple

- Agriculture multiple should be based on the fact that it is a trading business

- We may use a PE multiple of 10x for valuing this agriculture commodity business.

Summing it all together - Sum of Parts - SOTP Valuation of ITC

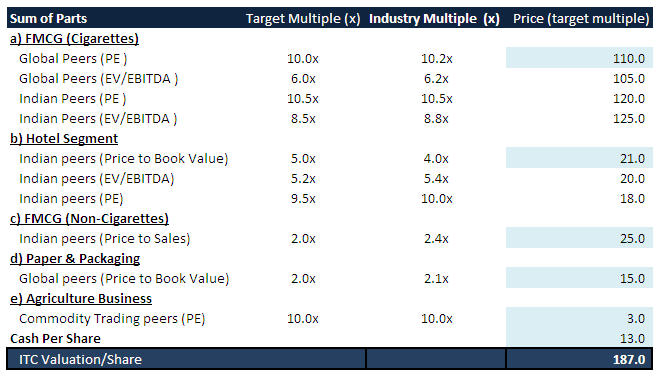

Below is the table that consolidates the valuation of all five segments. Please note that the various scenarios are used to evaluate the fundamental value of ITC. E.g., If Global Peers (PE) is used for valuing the FMCG segment, then the contribution to the share price is Rs110/share. However, if you used Global Peers (EV/EBITDA), the contribution would have been Rs105/share.

The final Sum of Parts valuation is =

Rs110 (FMCG-Cigarettes) + Rs21 (Hotel Segment) + Rs25 (FMCG - non cigarettes) + Rs15 (Paper and Packaging) + Rs3 (Agriculture Business) + Rs13 (Cash per share) = Rs187/share.

Sum of the Parts Valuation - SOTP - Waterfall Charts

The analysis done using the Sum of Parts looks stunning once you use the Waterfall Charts to communicate the analysis to the clients. Below is the waterfall chart of ITC Ltd Sum of Parts Valuation.The analysis done using the Sum of Parts looks stunning once you use theThe analysis done using the Sum of Parts looks stunning once you use the Waterfall Charts to communicate the analysis to the clients. Below is the waterfall chart of ITC Ltd Sum of Parts Valuation.

Download - ITC Waterfall chart

SOTP and Diversification Discount

Diversification discount also known as a conglomerate discount, typically arises when you value a company using the Sum of the Parts or SOTP. This happens because multiple business segments are valued where there is no adequate information on business metrics and a lack of management focus.

Diversification discounts range from 10% to 30% generally. However, it may change significantly for specific countries. For example, in India, the Diversification discount used for SOTP could be as high as 50%.

Limitations of Sum of the Parts Valuation

- The sum of parts or SOTP relies on adequate information provided for each segment. However, in most conglomerates, sufficient information is not available to value each business segment.

- Segment valuation under SOTP depends on the stage of its business cycle. This information is sometimes very difficult to find out due to limited information availability.

- Another problem with the sum of parts is that there are various synergies and cost savings associated with the functioning of each segment when they operate as a part of a conglomerate. While evaluating the segment separately, the synergies and costs are not available.

- SOTP valuation can only be fully realized if the management decides to break up the segments and run them as a separate company/unit. However, this becomes impossible as "company size" and management remuneration are generally closely linked, and the spin-off may not be in their interests.

What's Next?

If you learned something new or enjoyed the post on SOTP Valuation, please leave a comment below. Let me know what you think. Thanks and take care.