Table Of Contents

What Is DCF Formula (Discounted Cash Flow)?

The Discounted Cash Flow (DCF) formula is an income-based valuation approach that helps determine the fair value or security by discounting future expected cash flows. Under this method, the expected future cash flows are projected up to the company's life or asset, and a discount rate discounts the said cash flows to arrive at the present value.

The Discounted Cash flow (DCF) formula is an important business valuation tool that finds its utility and application in valuing an entire business for mergers and acquisitions. It is equally important in the valuation of Greenfield investments. It is also important for evaluating securities such as equity, a bond, or any other income-generating asset whose cash flows can be estimated or modeled.

Key Takeaways

- The Discounted Cash Flow (DCF) formula is an income-based valuation method used to determine the fair value of a security by discounting anticipated future cash flows.

- The formula involves projecting future cash flows over the life of the company or asset and discounting them back to their present value using a discount rate.

- The DCF formula can be applied to value both Free Cash Flow to the Firm (FCFF) and Free Cash Flow to Equity (FCFE).

- DCF analysis is commonly used for business valuation in mergers and acquisitions and plays a vital role in valuing Greenfield investments.

DCF Formula Explained

DCF model formula is a financial method of valuation and it is widely used to assess any investment value or estimate the valuation of a company or project. This calculation is done based on the cash flows projected for the future. The basic concept behind this technique is that the value of the cash flows in the future will be less than it is today because of the effect of the time value of money. Thus, the time value of money will reduce the worth of each cash flow as time passes by.

Image Source: Financial Modeling and Valuation Course

The basic formula of DCF is as follows:

DCF Formula =CFt /( 1 +r)t

Where,

- CFt = cash flow in period t.

- R = Appropriate discount rate that has given the riskiness of the cash flows.

- t = the life of the asset, which is valued.

It is to be noted that the discount rate which is used in the above DCF model formula is extremely important because it shows the risk associated with any investment or project. Typically, if the risk is higher, then the discount rate should also be higher. This signifies that due to higher risk the cash flows should be discounted more using a higher rate so that the present value is lower.

It is a metric that is widely used and a very effective method of valuation in the field of finance. However, the process also has its challenges. It is dependent on future cash flow calculations that may not be accurate all the time. The same is the case with the discount rate used in the formula. Even any minor change in this rate can cause a huge variation in the result obtained using the formula. Another drawback is that this method may not be suitable for all types of investments, projects or industries. If the cash flows are not predictable or steady, then it is difficult to use it. However, it is still widely used in the financial market.

Video Explanation Of DCF Formula

How To Calculate?

Now Let us look at how to use the DCF analysis formula for calculation of cash flow in a firm.

It is not possible to forecast cash flow for the whole life of a business. As such, cash flows are usually predicted for 5-7 years only and supplemented by incorporating a Terminal Value for the period after that . Terminal value is the estimated business value beyond the period for which cash flows are forecasted. It is an important part of the discounted cash flow formula and accounts for as much as 60%-70% of the firm's value and thus warrants due attention.

Image Source: Valuation Course

The terminal value is calculated using the perpetual growth rate or exit multiple methods.

Under the perpetual growth rate method, the terminal value DCF formula is calculated as: -

TVn= CFn (1+g)/( WACC-g)

Where,

- TVn =Terminal Value at the end of the specified period

- CFn = The cash flow of the last specified period

- g = the growth rate

- WACC = The Weighted Average Cost of Capital.

Under the exit multiple methods, the terminal value is calculated using multiple of EV/EBITDA, EV/Sales, etc., giving a multiplier. For instance, using exit, multiple ones can value the terminal with 'x' times the EV/EBITDA sale of the business with the cash flow from the terminal year.

FCFF And FCFE Used In DCF Formula Calculation

One can use the Discounted Cash Flow Formula (DCF) to value the FCFF or Free Cash flow to Equity.

Let us understand both and then try to find the relation between the two with an example: -

#1 - Free Cashflow to Firm (FCFF)

Under this DCF calculation approach, the entire value of the business includes the other claim holders in the firm besides equities (debt holders, etc.). The cash flows for the projected period under FCFF are computed as under: -

FCFF=Net income after tax+ Interest * (1-tax rate) + Non-cash expenses (including depreciation & provisions) - Increase in working capital - Capital expenditure

These cash flows calculated above are discounted by the Weighted Average Cost of Capital (WACC), the cost of the different components of financing used by the firm, weighted by their market value proportions.

WACC=Ke*(1-DR) + Kd*DR

When,

- Ke = the cost of equity

- Kd represents the cost of debt

- DR = The debt proportion in the company.

Cost of Equity (Ke) is computed by using the CAPM as under:

Ke=Rf + β * (Rm-Rf)

When,

- Rf = The risk-free rate

- Rm = The market rate of return

- β = Beta represents a systematic risk.

Finally, all the numbers are added to arrive at the enterprise value as under-

Enterprise Value Formula = PV of the (CF1,CF2…..CFn) + PV of the TVn

#2 - Free Cashflow to Equity (FCFE)

Under this DCF calculation method, the value of the equity stake of the business is calculated. It is obtained by discounting the expected cash flows to equity, i.e., residual cash flows, after meeting all expenses, tax obligations, and interest and principal payments. As a result, the cash flows for the projected period under FCFE are calculated as under: -

Image Source: Financial Modeling and Valuation Course

FCFE=FCFF-Interest * (1-tax rate)-Net repayments of debt

The above cash flows for the specified period are discounted at the equity (Ke) cost we discussed above. Then, the terminal value using the terminal value DCF formula is added (discussed above) to arrive at the equity value.

Examples (with Excel Template)

In this technique, we can also use the DCF formula in excel for our calculation and understanding.

Let us understand how enterprise/firm value and equity value are calculated using a discounted cash flow formula with the help of an example.

The following data is used to calculate the firm's value and value of equity using the DCF formula in excel.

Also, assume that the cash at hand is $100.

Valuation using FCFF Approach

First, we calculated the firm's value using the DCF formula.

Cost of Debt

Cost of Debt = 5%

WACC

- WACC = 13.625% ($1073/$1873)+5%( $800/$1873)

- WACC = 9.94%.

The calculation of the value of the firm using the DCF formula: -

Value of Firm= PV of the (CF1, CF2...CFn) + PV of the TVn

- Enterprise Value = ($90/1.0094) + ($100/1.0094^2) + ($108/1.0094^3) + ($116.2/1.0094^4) + ({$123.49+$2363}/1.0094^5)

Value of Firm using DCF Formula

Thus, the firm's value using a discounted cash flow formula = $1873.

- Value of Equity = Value of the Firm - Outstanding Debt + Cash

- Value of Equity = $1873 - $800+ $100

- Value of Equity = $1,173.

Valuation using FCFE Approach

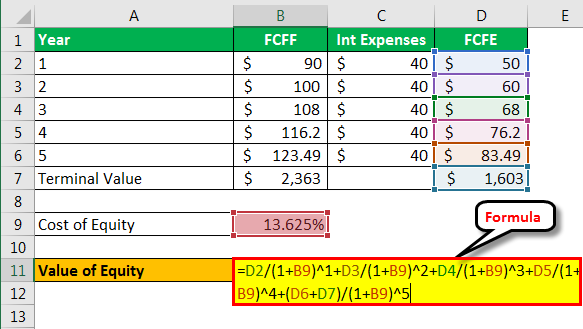

Let us now apply the DCF analysis formula to calculate the value of equity using the FCFE approach.

Value of Equity= PV of the (CF1, CF2...CFn) + PV of the TVn

Here, Free Cash Flow to Equity (FCFE) is discounted using the cost of equity.

- Value of Equity= ($50/1.13625) + ($60/1.13625^2) + ($68/1.13625^3) + ($76.2/1.13625^4) + ({$83.49+$1603}/1.13625^5)

Value of Equity using DCF Formula

Thus, the equity value using a Discounted Cash Flow (DCF) formula =$1073.

- Total Value of Equity = Value of Equity using DCF Formula + Cash

- Total Value of Equity = $1073 + $100

- $1073 + $100 = $1,173