Table Of Contents

Formula to Calculate Price to Book Value

Price to book value is an important measure to see how much equity shareholders are paying for the company's net assets value. The price to book value ratio (P/B) formula is also referred to as a market to book ratio and measures the proportion between the market price for a share and the book value per share. Here's the formula of price to book value –

Price to Book Value Ratio = Market Price Per Share/Book Value per Share

Explanation

There are two components of the P/B ratio formula.

- The first component is the market price per share. Market price per share is volatile, and it continually changes. The investor can decide to take the market price for a definite period and use an averaging method to find a median.

- The second component of this ratio is the book value per share. There are many ways we can calculate the book value of the company. The best and most common way to find out the company's book value is to deduct the total liabilities from the total assets. Doing this allows investors to find out the actual value at a certain time. Alternatively, the investors can also look at shareholders' equity to determine the book value.

As you can understand, this ratio tries to analyze the proportion of the market price of each equity share and the book value per share at a certain point in time.

Price to Book Value Formula Video Explanation

Example of P/B Ratio Formula

Let's take a practical example of how the P/B ratio formula works.

Binge-Watching TV wants to see how their investors perceive them in terms of book value. They took out their equity shares' market price and zoomed in on their balance sheet for the shareholders' equity. Here're the details they found out -

- Market Price of each share - $105 per share

- Book Value of each share - $84 per share

As an internal accountant, you need to determine the Price to Book Value Ratio.

To find out the P/B ratio formula, we need the market price per share and book value per share. In the above example, we know both.

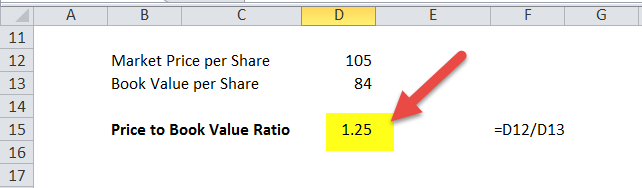

Using the P/B ratio formula, we get –

- P/B Ratio formula = Market Price per Share / Book Value per Share

- Or, P/B Ratio = $105 / $84 = 5/4 = 1.25.

Price to Book Value Ratio of Citigroup

Let us now apply the Price to Book Value formula to calculate Citigroup's Price to Book Value Ratio. First, we require Citigroup's Balance sheet details. You may download Citigroup's 10K report from here.

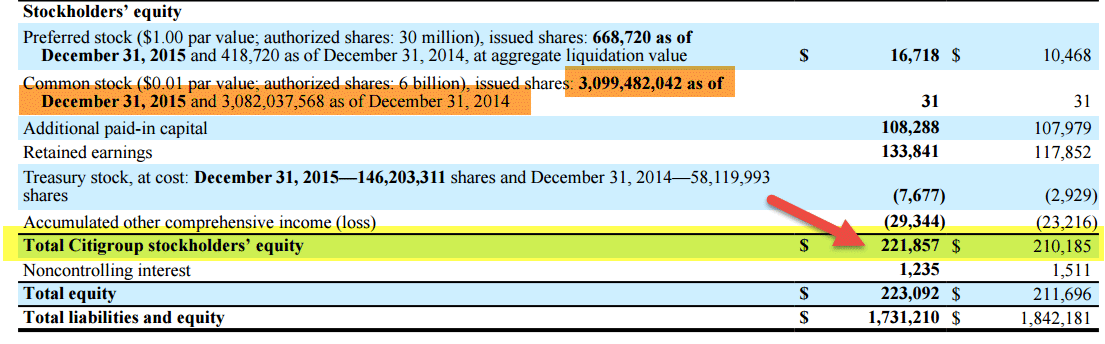

The below table shows the Consolidated Shareholder's equity section found on Page 133

From the table above, Citigroup's shareholders' equity was $221,857 million in 2015 and $210,185 million in 2014.

Corresponding common stock outstanding numbers are 3,099.48 million shares in 2015 and 3,083.037 million in 2014.

- Citigroup’s Book value in 2015 = $221,857 / 3099.48 = 71.57

- Citigroup’s Book value in 2014 = $210,185 / 3,083.037 = 68.174

Price of Citigroup as of 6th Feb 2018 was $73.27

- Citigroup Price to Book Value Ratio (2014) = $73.27/71.57 = 1.023x

- Citigroup Price to Book Value Ratio (2015) = $73.27/68.174 = 1.074x

Uses

- First of all, when an investor decides to invest in a company, she needs to know how much she needs to pay for a share of the net asset value per share. Having this comparison helps the investor decide whether this is a prudent investment or not.

- To take this further, many investors would like to do the valuation of the company's stocks. If the investors are investing in banking companies, insurance firms, or investment firms, this ratio can be useful for valuing the companies.

- One thing the investors need to keep in mind. This ratio is not useful for companies that need to maintain large assets, especially those with huge R&D expenditures or long-term fixed assets.