Table Of Contents

Valuation Interview Questions

In this Valuation Interview Questions and Answers, you will find the top 25 frequently asked questions in valuation covered from basic, advanced to application-oriented questions with answers that will help you crack the most difficult aspect of your valuation interview with zeal and confidence.

If you want to crack a valuation interview, you better be on your toes and prepare as much as you can; nowadays, you need to go both depth and breadth to answer interview questions.

Here we take up the top 25 valuation interview questions often asked in valuation interviews. They are by no way a substitute for your "preparation"; however, this guide will help you direct your attention to the right things.

Let’s get started. We have divided these top 25 valuation interview questions into three categories.

Valuation Interview Questions - Basics

Let us have a look at these basic valuation interview questions with answers.

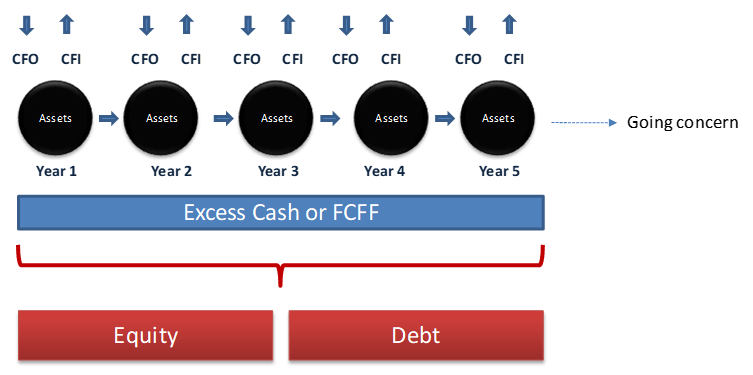

#1 - What is Free Cash Flow to Firm?

A company generates cash flows from its operations by selling goods or services. Some of its cash goes back into the business to renew fixed assets and for the working capital requirements. Free cash flow to the firm is the excess cash generated over and above these expenses. The firm's free cash flow goes to the debt holders and the equity holders. FCFF or Free cash flow to the firm is used in DCF financial modeling.

Free Cash Flow to Firm or FCFF Calculation = EBIT x (1-tax rate) + Non Cash Charges + Changes in Working capital – Capital Expenditure

#2 - What is Free Cash Flow to Equity?

FCFE or Free Cash Flow to Equity model is also one of the DCF approaches (along with FCFF) to calculate the Stock price. FCFE measures how much "cash" a firm can return to its shareholders and is calculated after taking care of the taxes, capital expenditure, and debt cash flows.

The FCFE model has certain limitations. For example, it is useful only in cases where the company’s leverage is not volatile and cannot be applied to companies with changing debt leverage.

FCFE Formula = Net Income + Depreciation & Amortization + Changes in WC + Capex + Net Borrowings

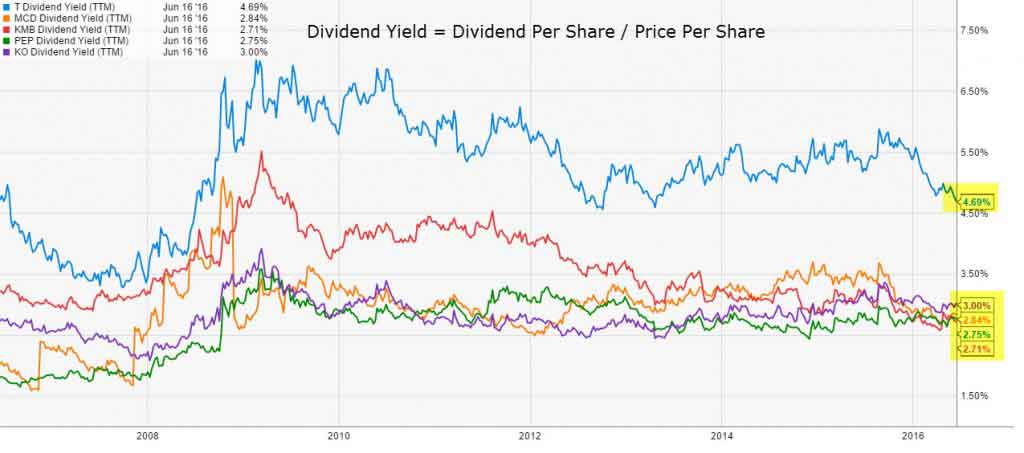

#3 - What is Dividend Discount Model?

The Dividend Discount Model is based on the understanding that the fair value of a stock is the present value of all its future dividends.

Here the CF = Dividends.

Some examples of regular dividend-paying companies are McDonald’s, Procter & Gamble, Kimberly Clark, PepsiCo, 3M, Coca-Cola, Johnson & Johnson, AT&T, Walmart, etc. We can use the Dividend Discount Model to value these companies.

source: ycharts

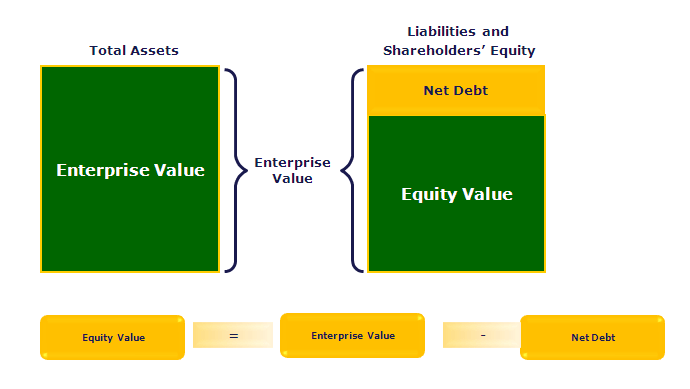

#4 - What is the Difference between Enterprise value and equity value?

This is one of the most basic interview questions on valuation. Straightforward answer -

- Enterprise Value = Market value of operating assets

- Equity Value = Market value of shareholders' equity

For more details, have a look at Enterprise value vs. Equity Value

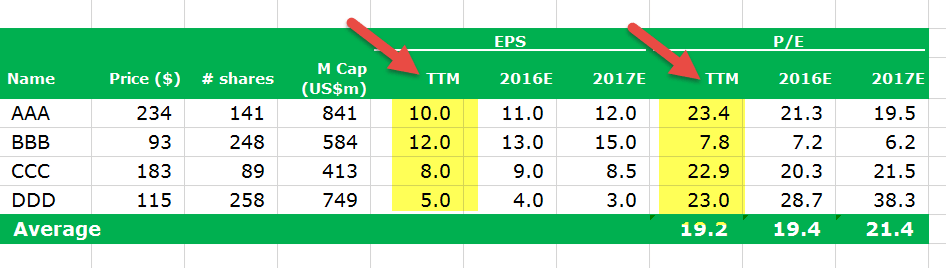

#5 - What is the difference between trailing PE and forward PE?

Trailing PE Ratio uses the Historical EPS, while Forward PE Ratio uses the Forecast EPS. Let us look at the below example to calculate the Trailing PE vs. forwarding PE Ratio.

- Trailing Price Earning Ratio formula = $234 / $10 = $23.4x

- Forward Price Earning Ratio formula = $234 / $11 = $21.3x

For more details, have a look at Trailing PE vs. Forward PE

#6 - What are the most common multiples used in valuation?

It is another basic valuation interview question. There are a few common trading valuation multiples that are frequently used in valuation –

- EV to EBIT

- Price to Cash Flow

- Enterprise Value to Sales

- EV to EBITDA

- PEG Ratio

- Price to Book Value

- PE Ratio

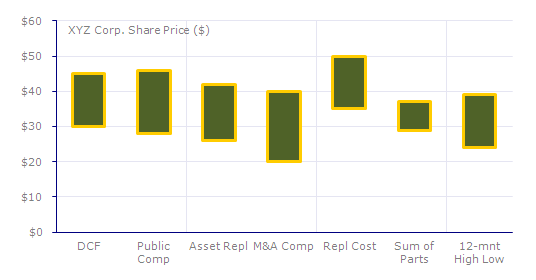

#7 - How would you present these valuation methodologies to investors?

The best way to approach this is to do your homework first. If possible, find out the firm's valuation using each methodology and then show it to the investors as a "football field" chart. It would be best to remember that you should always show a range instead of a specific number, as one needs to estimate many factors before coming to conclusions.

Learn more about Investment Banking Charts here

#8 - What are the three most used methodologies of valuation, and how would you rank them?

It is a pretty common question, but it's often asked. You would say – discounted cash flow analysis (DCF) Valuation, comparable comp analysis, and precedent transactions are the three most used methodologies for valuation. The ranking question is tricky. Usually, precedent transactions are higher than the comparable companies as a control premium is built into it. In the case of DCF, it can go both ways (highest or lowest) depending on your assumptions during the calculation.

#9 - Other than these three, what are the other methodologies? Give a brief.

Other than the above 3, you can talk about the following methodologies –

- LBO Analysis: LBO Analysis helps a firm determine how much PE a firm would be able to pay to hit the “target IRR” (generally, the “target IRR” happens to be in the range of 15-25%).

- Sum of the Parts: This has two steps. Firstly, each part is valued separately. And then, they are added together.

- Liquidation Valuation: The whole idea of Liquidation Value is to imagine that all the company's assets are sold off. And then, once the figure comes up, the liabilities are subtracted from the figure. It is the capital (if at all) equity investors receive.

- M&A Premiums Analysis: First, M&A deals are analyzed to determine how much premium each buyer paid and then utilize the information to determine how much the company is worth.

- Replacement Value: The valuation of replacing the company's assets would be the replacement value.

#10 - What is precedent transactional analysis?

In simple words, the precedent transactional analysis is a valuation method that takes the past transactions of similar companies to value a company.

If we break down this method in a few steps, here are they –

- Firstly, similar companies are chosen based on similar features or in a similar industry.

- Secondly, the size of the transactions should be similar.

- Thirdly, the type of transaction and the features of buyers would be the same.

- Fourthly, transactions that happened more recently have been considered more valuable.

- Fifthly, the estimate is being made on the basis of the above factors.

#11 - Are there any factors through which you can choose comparable companies?

This valuation interview question should be easy to answer. There are exactly three factors that are used to choose comparable companies.

- Firstly, the most important factor is the industry classification. This is most important because, on the basis of this, the companies can be easily compared at a high level.

- Secondly, you need to consider the financial criteria if you want to go more specific. Under financial criteria, you would look at revenue, EBITDA, EBITDAR, EBIT, etc.

- Thirdly, the last you should consider is geography.

Usually, the first factor (industry classification) is used most, and the least used factor is geography.

Valuation Interview Questions and Answers Explained in Video

Valuation Interview Questions - Application

Let us have a look at the application-oriented valuation interview questions (with answers)

#12 - How do you value a bank?

This one is a common valuation interview question. Be sure to answer this correctly.

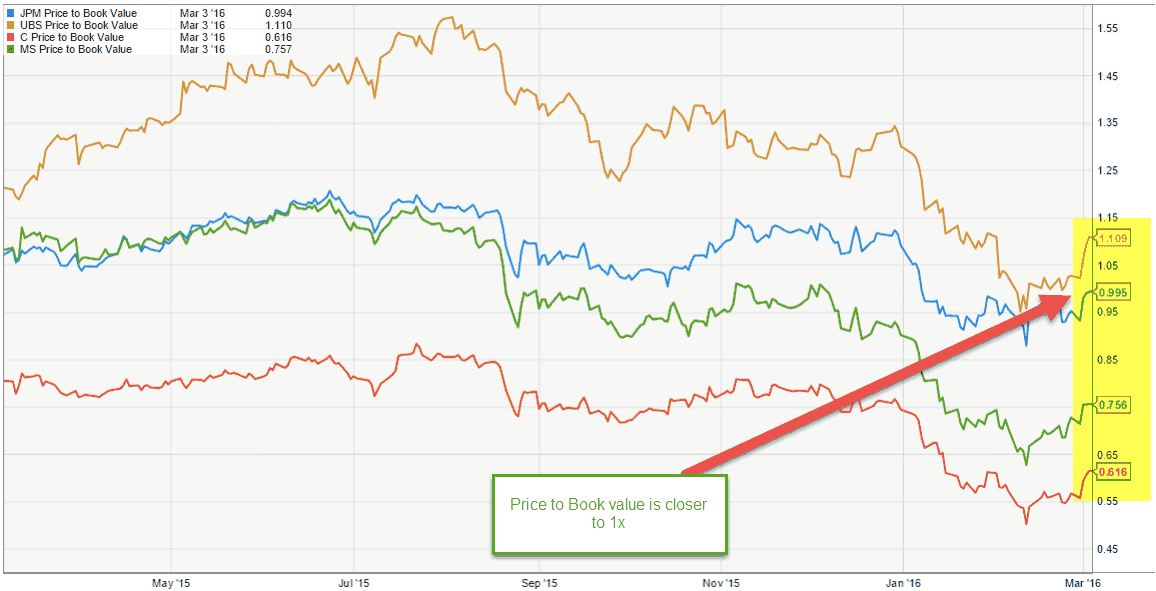

Banks are primarily valued using Price to Book Value multiple. This is because of the following reasons -

- Banks have assets and liabilities that are periodically marked to market, as it is mandatory under regulations. So, the Balance Sheet value represents the market value, unlike other industries where the Balance Sheet represents the historical cost of the assets/liabilities.

- Bank assets include investments in government bonds, high-grade corporate bonds or municipal bonds, along with commercial, mortgage, or personal loans that are generally expected to be collectible.

The below graph shows a quick comparison of the Historical Book values of JPMorgan, UBS, Citigroup, and Morgan Stanley.

source: charts

#13 - What are some examples of industry-specific multiples?

This one is another important valuation interview question. Industry-specific multiples vary as per the industrial factors. Let’s look at four examples –

- Real Estate Investment Trusts (REITs): Price / Funds from operations (FFO); Price / Adjusted Funds from operations (AFFO)

- Retail or Airlines: Enterprise Value (EV) / Earnings before interests, taxes, depreciation, amortization, and rent (EBITDAR)

- Technology: EV / Unique Visitors; EV / Page-views

- Energy: Price (P) / Net Asset Value (NAV); P / 1 million cubic foot equivalent (MCFE); P / 1 million cubic foot equivalent per day (MCFE / D)

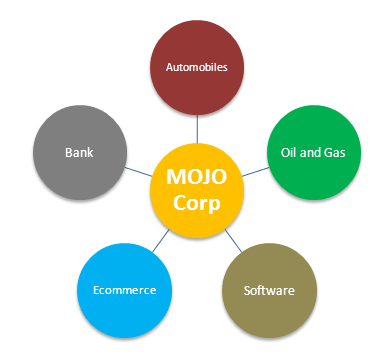

#14 - When would you use the sum of the parts?

The sum of the parts is mostly useful for companies with several divisions unrelated to each other. For example, if a company has an energy division, consumer finance division, technology division, and media division, the sum of the parts would be pretty useful.

Let us understand the Sum of the Parts valuation using an example of a large conglomerate company (ticker MOJO) that operates the following business segments.

- Automobile Segment Valuation – Automobile Segment could be best valued using EV/EBITDA or PE ratios.

- Oil and Gas Segment Valuation – For Oil and Gas companies, the best approach is to use EV/EBITDA or P/CF or EV/boe (EV/barrels of oil equivalent)

- Software Segment Valuation – We use PE or EV/EBIT multiple to value Software Segment

- Bank Segment Valuation – We generally use P/BV or Residual Income Method to value Banking Sector

- E-commerce Segment – We use EV/Sales to value the E-commerce segment (if the segment is not profitable) or EV/Subscriber or PE multiple

#15 - When would you use a liquidation valuation & when liquidation valuation will produce the highest value?

Liquidation valuation is useful when there are any bankruptcy situations. If a company has a chance to go belly up, liquidation valuation will help understand how much capital equity investors will get after the debts have been paid off.

Liquidation valuation producing high value is highly unlikely. But if the market is severely undervaluing assets for a particular reason and the firm has substantial hard assets it could be possible. Due to this, the company's comparable companies and precedent transactions would generate lower values, and as assets are valued pretty highly, liquidation valuation will produce a higher value.Liquidation valuation producing high value is highly unlikely. But if the market is severely undervalued for a particular reason and the firm has substantial Liquidation valuation producing high value is highly unlikely. But if the market is severely undervaluing assets for a particular reason and the firm has substantial hard assets, it could be possible. Due to this, the company's comparable companies and precedent transactions would generate lower values, and as assets are valued highly, liquidation valuation will produce a higher value.

#16 - In the case of free cash flow multiples, what would you use – equity value or enterprise value?

There are two things to remember here. First, in the case of unlevered free cash flow, you need to use enterprise value.

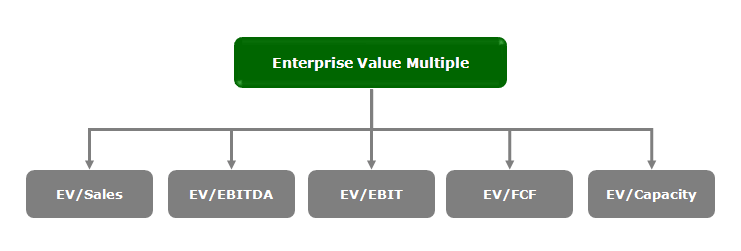

Below are the enterprise value multiples -

And, in the case of levered free cash flow, you should use equity value. Here’s why. In unlevered free cash flow, interest is excluded. Thus, money is available to investors. But in the case of levered free cash flow, interest is included; thus, it is only available to equity holders.

Below is the list of Equity Value Multiples -

Valuation Interview Questions - Advanced

Let us now look at some of the advanced Valuation Interview Questions.

#17 - Which is Better PE or EV To EBITDA

This one is a tricky valuation interview question. Most people use the PE ratio as the primary valuation tool. However, there are several limitations of PE Ratio due to which EV to EBITDA is considered a better valuation multiple.

- PE Ratio does not consider balance sheet risk. The fundamental position of the company is not reflected correctly in PE Multiple.

- The different debt-to-equity structures can significantly affect the company's earnings. Earnings can vary widely for companies with debt due to a component of Interest Payments affecting the Earnings Per Share.

- It cannot be used when earnings are negative. For example, Box Inc. You cannot simply find PE Multiple for such unprofitable companies. One must use normalized earnings or forward multiples in such cases.

- Earnings are subject to different accounting policies. It can be easily manipulated by management.

#18 - How do you value Box?

Have a look at the above Box IPO Financial model with forecasts. We note that BOX is making losses not only at the Operating but also at the Net Income Level. How do you value such companies that grow fast but are free cash flow negative?

In such cases, we cannot apply valuation multiples like PE ratio (due to negative earnings), EV to EBITDA (if EBITDA is negative), or DCF approach (when FCFF is negative). The valuation tool that comes to our rescue is EV to Sales!

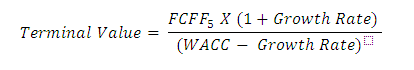

#19 - Can Terminal Value be Negative?

Another tricky valuation interview question. The answer is theoretically YES, Practically NO!

Theoretically, this can happen when the Terminal value is calculated using the perpetuity growth method.

In the formula above, if we assume WACC < growth rate, then the Terminal Value derived from the formula will be Negative. It is very difficult to digest as a high-growth company is now showing a negative terminal value because of the formula used. However, this high growth rate assumption is incorrect. We cannot assume that a company will grow at a very high rate until it is infinite.

For more details, please have a look at this detailed Guide to Terminal value

#20 - When would you not use a DCF in valuation?

In two particular situations, you should never use DCF –

- Firstly, if the firm has unpredictable or unsteady cash flows;

- Secondly, when debt and working capital serve a completely different role altogether. For example, DCF is not used to value banks as banks and financial institutions don't reinvest their debt and working capital.

#21 - Would an LBO or DCF give higher valuation? Why?

Usually, DCF will give a higher valuation. Unlike DCF, in LBO analysis, you won’t get any cash flow between year one and the final year. So the analysis is done based on terminal value only. In the case of DCF, the valuation is done both based on cash flows and the terminal values; thus, it tends to be higher.

Moreover, in LBO, an expected IRR (Internal Rate of Return) is set up, and then the valuation is done.

#22 - Let's say that a company has no profit and no revenue. How would you value that company?

The simplest way to look at it is to say that the company's valuation would be done by using other metrics. There is no profit and no revenue, and there won’t be any cash flow. Thus, using creative multiples that will go with the inherent nature of the business will do the trick.

#23 - How would you value a mango tree?

It may seem to be a tricky question, but it's not if you think it through.

When you are asked this question, you would say that the mango tree would be valued as a company can be valued – first by glancing toward the comparable mango trees and what they are worth (i.e., relative valuation) and then finding out the value of the mango tree's cash flows (i.e., intrinsic valuation).

#24 - What are the flaws with public company comparables?

There may be various flaws with public company comparables. But the following three stands out –

- The stock market doesn’t have a fixed way of reacting. It reacts impulsively to the events or happenings in the market. So, it is very difficult to predict the stock market's reaction on a given day. Thus, the factors you use may not help you at all.

- A 100% comparison of one company with another is never possible. There will always be room for error.

- The smallest companies have the tiniest stocks. And these stocks may not always reflect the actual value of the company.

#25 - How would you value a private company?

Valuing a private company is slightly different than valuing a public company. Of course, you will use the comparables, precedent transactions, DCF, but here are a few differences –

- First of all, you need to think about the liquidity of the private company. Naturally, private companies wouldn’t be as liquid as public companies. Thus, while valuing the private company, the discounting rate would increase.

- It wouldn’t be possible to use future share price analysis; because there would be none.

- DCF becomes very difficult as there is no beta in the case of a private company.

In the case of a private company, the enterprise value would be taken into account.