Table Of Contents

What Are Qualitative Factors?

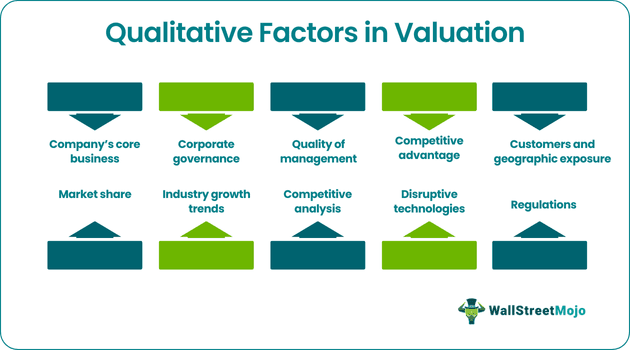

Qualitative Factors in Valuation are the different factors in the valuation of the business or the investment which are not possible to quantify directly but are equally important as the quantitative factors and include the factors such as quality of management, competitive advantage, corporate governance, etc.

Valuations are done using quantitative data (like Income Statements, Balance sheets, Cash Flows, etc.) from the Annual Reports. Think about preparing a Financial Model of a company and applying valuation tools like DCF, Relative Valuation tools like PE ratio, EV/EBITDA, etc., to value the company. However, other "not-so-tangible" factors also impact the valuation of the business.

This article will look at the qualitative factors in valuation in detail.

Key Takeaways

- Qualitative factors in valuation are various aspects of a business or investment that cannot be directly quantified but are just as significant as quantitative factors.

- Valuations use quantitative information from annual reports, including financial models and techniques like DCF, relative valuation tools, and PE ratios. Other less tangible elements can also impact a firm's worth.

- Top ten factors are the company's core business, quality of management, customers and geographic exposure, competitive advantage, corporate governance, industry growth trends, competitive analysis, disruptive technologies, market share, and regulations.

What do we mean by qualitative factors in valuation?

Qualitative factors are the factors in business valuation that are almost impossible to quantify for business. Or we can say that these are the factors in business valuation that can’t be directly quantified. But they are equally, if not more important than quantitative factors in valuation. And at the same time, no company can ignore these less tangible factors because they matter in valuing a company.

Numbers are not the only thing that matters when evaluating a business. Other factors may skip your mind as an investor.

In the next section, we will go into the meat of the article, which will help you make smarter business decisions, and you will be able to think through a completely different perspective before ever spending a buck on a stock.

Video Explanation of Qualitative Factors in Valuation

List of Top 10 Qualitative Factors

Here is the list of top 10 qualitative factors -

#1 - Company's Core Business

As an investor, your first concern should be – "How does a business make money?" According to a recent definition of business, money-making may not be the sole ingredient of a good business. But as an investor, you should invest in a stock that will make you money. It is essential to peep through their revenue model and determine whether it will work in the long run.

For example, look at the business model of KFC. We will see that they sell delicious chicken burgers, chicken roasts, and many varieties of mouth-licking chicken and veg recipes, and their business model is straightforward to follow. As an investor, you know that this is how KFC makes money.

Similarly, before ever spending a penny on any stock, know the business model. Find out its history, revenue generation model, how it got started, how long they are in the market, and the revenue and profit margin they have been maintaining. And then go for business valuation. Do your due diligence.

As seen in the below Facebook business overview, it provides us with information on how the revenue is generated. Facebook generates all of its revenue from selling advertisement placements to marketers.

source: Facebook SEC Filings

#2 - Quality of Management

The second factor is the quality of management in the company. If the management is motivated enough to steer the company toward its summit, the company will be a tremendous force. It would always find a way even amid the most significant economic turndowns.

So before you invest in a company, having a check on the management quality is of utmost importance. Having the most significant business model will not serve unless the company's management quality is at par.

So what would you do?

Every company nowadays has a website where they mention their "teams." Go through the page, find out who the company's promoters are, filter out their background on different levels, and find out what experiences they have in a similar industry.

It will give you a brief overview of the company. But that is not all. You need to dig deep and see what the management is really up to.

- History of performance: Results don’t lie. And when a company brings in astounding results, that means there is a hand behind the management in it. Now go through the performance histories of top executives in the last decade, and you will get a reasonable idea about whether it is prudent to invest in the company.

- Management Discussion & Analysis (MD&A): Every public company needs to produce an annual report per the 10-K filing. Look at the annual report. In the beginning section, you will find something like MD&A. In that section, you will get all the ideas about what worked for the company and what didn’t. And you will also be able to glance at the company's financial statements. Which division fetched the maximum output in the last year? Below is a snapshot from Facebook Management Discussion and Analysis.

source: Facebook SEC Filings

- Look for insider information: If you are researching a company, you need to make a "one plus one equals two." A company that is doing outstanding because of someone's effort. For their effort, the company is reasonably compensating them. Look for stocks. How many stocks are given to a top executive, and why? Why has been given the stocks? What performances s/he has had in the past?

#3 - Customers and Geographic exposure

There are two basic things you need to check out if you want to penetrate the actual picture of the company.

First, you need to find out about the customers of the company. Does the company have a few big customers or many small customers? Does the company serve only businesses or end customers as well? Does their focus revolve around a niche market, or do they cover all segments of customers? To understand a company, getting answers to the above questions is essential. Because then you will understand where the company stands as per the customers' mind-map.

Second, you need to find out the geographical exposure of the company. Does the company only operate in certain territories? If yes, why? Does the company cover only urban or rural areas? What are their sales broken down as per each territory? Where do they sell more, and why? Asking yourself these questions and searching for answers will help you know the company well and make wiser choices at the end of the day.

In its Form 10K, Facebook has provided us with Geographical information. We note that the United States is the major contributor to Facebook's revenue. The rest of the world's share is seeing a rapid rise, thereby diversifying geographical risk.

source: Facebook SEC Filings

#4 - Competitive Advantage

Before you ever evaluate a company in quantitative terms and judge the company based on figures, you need to find out what the company's competitive advantage. Competitive advantage is a term coined by Michael Porter. He says there are a few factors that are important for a company to have, to be called a competitive advantage –

- The competitive advantage is a unique ability that can’t be emulated by other companies easily.

- Competitive advantage helps the company produce more profits, revenue, efficient systems, and processes.

- Competitive advantage helps all the company's activities get aligned with the organizational strategy.

- Competitive advantage helps a company receive benefits, usually for five-to-ten years.

For example, suppose a company sells online. In that case, its logistics can be its competitive advantage, which can help them reach its customers super fast and deliver goods and products faster than its competitors.

As an investor, you need to think through the competitive advantage or lack of it before investing in it because competitive advantage or lack of it is the sole ingredient of producing astounding or mediocre results!

#5 - Corporate Governance

In simple terms, corporate governance is the holy grail of a sustainable business. If the corporate governance is not in order, the whole business will crumble sooner or later. So, checking out a company's corporate governance is of utmost importance as an investor.

You need to see three things –

- Are the company's rules aligned with the company’s mission and vision?

- Is the company serving every stakeholder well?

- Are they legally compliant with the government’s policies?

If the answer to the above three questions is “yes,” usually, the company is pretty good at corporate governance.

Below are the Corporate Governance guidelines of Facebook.

source: Facebook Corporate Governance

#6 - Industry Growth Trends

Doing your due diligence doesn’t end at the company level. It would be best to determine which sector the company is in and then see the industry in the researcher's light. You should gather the data for the last ten years and then use different tools to see whether you seem to find any pattern or trend or not.

In this case, quantitative factors may help you get an idea about the qualitative factors. Look at different trends, analyses, experts’ forecasts, and suggestions. But make sure that you decide based on your thinking and your knowledge of the data. Don’t put the industry on a higher rung because an expert says so.

Once you know the trends, you will have definite ideas about predicting the future trends of the company.

#7 - Competitive analysis

Many investors skip this.

But if you want to know the right value of a company, look at their competitors and analyze.

Look at their strengths and compare them with the company you want to invest in. Look at their weaknesses and see how your targeted company is doing in those areas.

Doing competitive analysis will help you the position of a company, but it will also help you discover similar companies to invest in shortly.

The industrial analyses can’t be done by taking competition into account. The only comparison with similar companies can give you an overview of how a company is doing in the same industry.

Facebook competes with lots of players, including Google, Snapchat, etc.

source: Facebook SEC Filings

#8 - Disruptive technologies

Technologies can shape or break a company.

Look for disruptive technologies that have shaped the industry altogether. And then see whether the company you are evaluating uses those technologies or not.

In this age of continuous advancement of technologies, only disruptive ones cause a stir in the industry. And before you ever invest in any company, look for the technological state of the industry first.

One disruptive technology for Facebook is Oculus. Oculus virtual reality technology and content platform power products allow people to enter a completely immersive and interactive environment to play games, consume content, and connect with others.

#9 - Market share

The company doesn’t need to have a significant share in the market, especially when it has been in the market just for some time. But what we need to look at as investors is whether it has the potential to grow or not.

You can use BCG Matrix or any other strategic tool to find out where this company belongs and then evaluate it.

As an investor, it is essential to know that the company can grow shortly. If a company has reached its saturation point and there is little or no growth (rather a downward slope along the way), investing in it wouldn’t be a great idea.

#10 - Regulations

No company can be free of regulations. And when you attempt to evaluate a business, you need to see the regulatory factors.

For example, the FDA (Food and Drug Administration) has direct regulations on the pharmaceutical industry. According to the FDA, before any drug comes into the market, it has to go through a series of clinical trials before reaching the end customers.

However, not all industries have the same regulatory constraints. So, as an evaluator, you need to see whether the company is following all the regulatory practices or not.

source: Facebook SEC Filings

The idea is to find out the regulatory factors that can directly impact the bottom line (think net profit) of the company. To discover this, you need to dig deep, read all the company's financial statements, and go through the annual report.

Frequently Asked Questions (FAQs)

What qualitative factors influence investment appraisals?

Do qualitative factors have an impact on decision-making?

What qualitative factors influence productivity?

How do analysts assign a monetary value to qualitative factors during valuation?

In the final analysis

It is always easier said than done. Even the most revered investor Warren Buffett doesn’t invest in technology stocks. If you ask him why he would say that he doesn’t feel that he has expertise in that area.

Now that’s something the investors should think about.

It is not enough only to take qualitative and quantitative factors into account. It’s also essential to build an area of expertise where you are more thorough and where you have better instincts.

And you would know that with experience.

Try out the above factors while evaluating a business, and then see how they impact your overall business value calculation.

The above may seem easy on paper, but to implement these, you need to go through countless research papers, countless data, impossible amounts of graphs, trends, analysis, and an amazing number of books. It is not easy, but worth the effort.

When you take these “not-so-tangible” factors into account, you will become a better investor and will be able to calculate the right price for a company.