Table Of Contents

What Is Price Target?

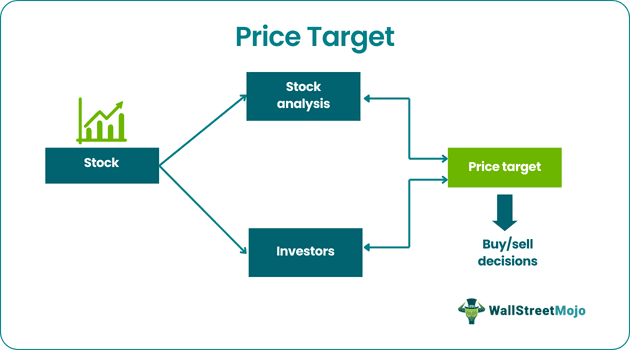

A price target in the context of stock markets means the expected valuation of a stock in the coming future. The valuation may be done either by the stock analysts or by the investors themselves. For an investor, a price target reflects the price at which he will be willing to buy or sell the stock at a particular period or mark an exit from their current position.

It is helpful for all financial and investment products and determines how much the security price will be a few months or years later. It depends to a great extent on the financial condition of the company and its future growth prospects. Analysts calculate this value and publish in reports to recommend investors regarding the buy, sell, or hold decisions.

Key Takeaways

- A price target refers to the expected stock valuation in the future. In this process, the stock analysts or the investors perform the valuation.

- It shows the price for an investor at which they may trade the stock at a specific period or record withdrawal from the existing setting.

- It helps investors to understand the right time to exit or enter the market.

- It needs expert prediction. Therefore, an individual investor may need help to perform the calculations and must depend only on market experts.

Price Target Explained

Price target is the value of securities that calculate and project for the future. These prices are the views of stock analysts regarding the performance of companies in the coming days based of their past and present condition.

Various methods are used to do the price target research and determine this price, among which the price to earning ratio and the discounted cash flow technique are very common.

It is a concept used by market analysts who watch the company's stock and analyze various factors affecting its price, price-to-earnings ratio, etc. Then, they use price targets to give opinions on different stock positions.

However, this does not guarantee that the price quoted by analysts cannot change. There is always a possibility of fluctuations a per the market conditions are any unpredictable change in company operations and management.

Formula

Let us look at the price target formula to understand it.

Price Target = Current Market Price *

There are two types of P/E used in the above formula: Current P/E and Forward P/E.

- Current P/E

This price-earnings ratio uses the earnings for the past twelve months. Thus, the current market price is divided by the average earnings of the last twelve months.

- Forward P/E

In the Forward P/E ratio, the estimated earnings for the next twelve months are considered. The ratio is calculated by dividing the market price by the average estimated earnings for the next twelve months.

The above ratios are helpful as price target calculator for analysts.

Thus, we see that the price target formula mentioned above is used to calculate it.

Example

A stock of a company is trading at $80 currently. The current earnings per share are $2. However, the estimated earnings per share are $2.5.

Solution

- Current P/E = 80/2 = $40

- Forward P/E = 80/2.5 = $32

Calculation of Price Target

- = 80 * (40/32)

- = $100

Advantages

- The price target upside is that it helps an investor decide whether he should hold the stock in expectation of an increase in future price or sell the share as it has already reached its target.

- It helps investors to decide the right time to exit or enter the market.

Disadvantages

- It is based on the estimates of the future price-to-earnings ratio, which in turn means it depends on future earnings estimates. Unfortunately, it is difficult to predict future earnings accurately. Thus, the target price is subject to the limitation that the forecast may not be accurate, and the actual price can be different from the target price, affecting the investor's strategy.

- It involves expert prediction. Thus, an individual investor may not be able to do the calculations using any price target calculator and will need to depend only on market experts.

Price Target Vs Fair Value

A price target research estimates the price at which the investors are expected to buy or sell a particular stock. It does not reflect the actual worth of the stock. The investors will use it to decide whether it will be appropriate to buy or sell the stock based on its current market price, or the investor can wait to take his position.

On the other hand, the fair value of a stock reflects the stock's intrinsic value or actual worth of the stock, in other words. Therefore, it helps investors decide whether a stock is overvalued or undervalued. Furthermore, the price target upside is that an investor can determine whether it is a good deal to buy or sell the stock regarding the current market price and fair value.