Table Of Contents

What Is EV to Assets?

EV to Assets is a ratio that acts as an important valuation metric for measuring the value of the company with respect to its total assets and is very helpful in comparing valuations of companies across similar stocks in the sector.

EV stands for Enterprise Value, which, here, is the sum of current market cap, debt, minority interest, and preferred shares minus cash or cash equivalents. To calculate EV to assets ratio, the total enterprise value is divided by the total assets of the company.

Key Takeaways

- EV to assets ratio is a crucial metric measuring a company's total assets value. Comparing valuations of companies in the same sector can be helpful. Divide enterprise value by total assets to calculate.

- Enterprise value accounts for equity and debt, while market capitalization only considers equity. It makes enterprise value a more accurate measure of a company's worth and can be used to estimate the cost of acquiring a business.

- When investing, consider EV to assets ratio and be cautious of overestimating assets, intangible asset valuation challenges, depreciation, and legal issues affecting fixed asset value.

EV to Assets Explained

EV to assets refers to the ratio of enterprise value to assets. The EV signifies the value of the enterprise, thereby helping firms know how much their firm is worth. On the contrary, assets indicate the resources that the companies have. When the former is divided by the latter, the figure obtained lets companies know their worth.

Enterprise Value is thought of as representative of the company’s actual value, which considers both its equity and debt to arrive at a realistic figure of what a company is truly worth. Unlike market capitalization, which looks at equity in isolation, EV helps paint a more realistic picture of the value of a business by adding debt to the figure.

EV is often contrasted against Market Capitalization for their difference in the approach adopted for evaluating a company. EV can also be considered the ‘takeover price’ of a business, which is why cash and its equivalents are deducted from the total debt to give an idea of the net debt that would need to be paid after the business acquisition.

Enterprise Value Formula = Market Capitalization + Debt + Minority Interest + Preferred Shares – Cash and Cash Equivalents

Assets, on the other hand, are a different concept, comprising different constituents. These include long-term business assets, such as real estate, and current assets, such as receivables. They can also be defined as core assets, which might have a direct role in business operations, and non-core assets, which have a little direct role in business operations.

A high EV to Assets ratio reflects that a business is overvalued with respect to its assets. On the contrary, when the EV to Assets ratio is low, it denotes that a business is undervalued. The ratio allows investors to have a clue about the capital structure of a company. The investors analyze the figures and assess how significant the face value is, in case they look forward to investing in its debt

EV to Assets can be a useful financial metric for anyone willing to invest in a business, along with other enterprise valuation multiples. Several other ratios arrived by dividing various financial metrics by EV, and this is perhaps one of the most significant of all these ratios.

Formula

The formula for EV to Assets is mentioned as follows:

EV/Assets = Enterprise Value {Market Capitalization + Debt + Minority Interest + Preferred Shares - Cash and Cash Equivalents} / Assets

Example

Let us look at the below calculation of EV to Assets.

- Company ABC: Enterprise Value (31 Million) / Assets (22 Million) = 1.409 (EV to Assets)

- Company XYZ: Enterprise Value (23 Million) / Assets (20 Million) = 1.15 (EV to Assets)

Here it can be seen that the company with a lower EV to Assets value, i.e., Company XYZ is a much better choice than Company ABC because of a higher proportion of assets compared to its enterprise value.

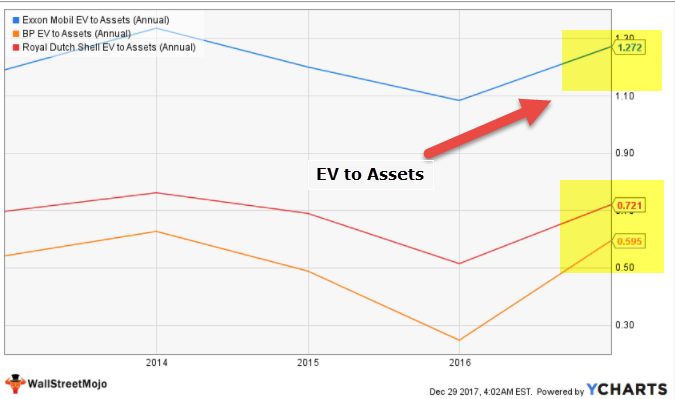

With this, let us look at an example from the Oil & Gas sector.

source: ycharts

Suppose we do not consider any other valuation parameter and go only by EV to Assets. We note that the EV to Assets of Exxon Mobil, Royal Dutch Shell, and BP are 1.27x, 0.72x, and 0.59x. In that case, BP is a better choice as it has a higher proportion of Assets when compared to its enterprise value.

Advantages and Disadvantages

EV to Assets ratio is an important metric as it helps assess the exact value of the company after the considerable enterprise value components are calculated with respect to the total assets it holds. However, besides being advantageous, the EV to asset ratio also has some limitations, which firms and individuals must be aware of.

Let us look at the benefits and limitations of the ratio in detail below:

Pros

- EV to Assets is a key valuation multiple. It is especially useful if the business is asset-driven, and Return On Assets (ROA) is more or less constant. It would also make assets the perfect indicator of Future Cash Flows (FCF).

- A high EV to Assets multiple indicates the business is overvalued concerning the value of its assets, and if it’s on the lower side, the business is undervalued.

- This valuation multiple helps look at an investment from the point of view of its capital structure. It gives a fundamental idea of the value of an investment, especially in asset-driven industries. Keeping the total value of the capital structure of a business in mind, investors can better understand if the face value is attractively priced to buy its debt, if nothing else.

- Assets are one of the key determinants of the value of a firm, which might be of immense utility in helping understand the actual worth of a business. However, the value of certain types of assets, for instance, intangible assets, can more than often stand on mere assumptions. On the other hand, even fixed assets might be entangled in issues that can affect their actual worth.

- It must always be remembered that assets can be defined and categorized in various ways, which can play into this figure and lead to an erroneous impression of what a business might be worth in terms of its capital structure.

- It can be used with a considerable advantage in comparable company analysis which would give a fair idea of where a company stands against its peers in terms of its capital structure.

Cons

- Assets might be exaggerated on the balance sheets or evaporate in thin air the moment their real worth is estimated, all too often with intangible assets. This ultimately affects the EV to Assets calculation, thereby resulting in inappropriate figures.

- Depreciation in the value of assets is another factor, along with many legal and other issues that can even put a question mark on the true worth of fixed assets at times.