Table Of Contents

What Is Book To Market Ratio?

The Book to Market ratio compares the book value of equity with the market capitalization, where the book value is the accounting value of shareholders' equity. It is computed by dividing the current book value of equity by the market value. In contrast, market capitalization is determined based on the price at which the stock is traded.

It is always recommended to use other fundamental variables while interpreting a ratio. These fundamental variables could be growth rate, return on equity, payout ratio, or the expected risk in the company. To a large extent, any changes in these fundamental variables will explain the ratio and must be considered while concluding if the stock is undervalued or overvalued.

Key Takeaways

- The market-to-book ratio is a financial metric to measure a company's current market worth compared to its book value.

- This metric is calculated using two ways:

- Market to book ratio = market value of share/ book value per share Market to book ratio = market capitalization/ total book value

- It can be interpreted in two ways: if the ratio is less than one, it refers to an undervalued stock which is a good investment as the stock's price increases.

- If the ratio is more than one, the stock price can be deemed overpriced, indicating gaps in its current price determination. It can be a bad investment as the stock price might come down.

Book To Market Ratio Explained

The book to market ratio is an equity multiple. Equity multiple generally requires two inputs- the market value of equity and a variable to which it is scaled (earnings, book value, or revenues). As the name suggests, the variable to which this book to market ratio growth stock is scaled is the book value of equity.

The book value of equity, also known as the shareholders’ equity, includes the retained earnings and any other accounting adjustments made to book equity along with the paid-in capital. Book value is based on accounting conventions and is historic.

The market value of equity, on the other hand, reflects the market’s expectations of the company’s earning power and cash flows and is determined by multiplying the current stock price by the total number of outstanding shares. The current stock price is readily available from the exchange on which it is traded.

The low or high book to market ratio gives a fair idea of whether the common stock of the company is undervalued or overvalued. A ratio of less than 1 (ratio < 1) can be interpreted as the stock being overvalued, while a ratio greater than 1 (ratio > 1) can be interpreted as the stock being undervalued. However, this is only a simple analysis and is not recommended (in isolation) since the fair value should also account for future expectations, which this ratio fails to consider.

Formula

This positive or negative book to market ratio is not meaningful when subject companies have huge internally-generated intangibles such as brands, customer relationships, etc., which do not reflect the book value. It is hence, best suited for companies with real assets in books such as insurance, banking, REITs, etc. Hence, while making any investment decisions, it is essential to consider other ratios and the underlying fundamental variables.

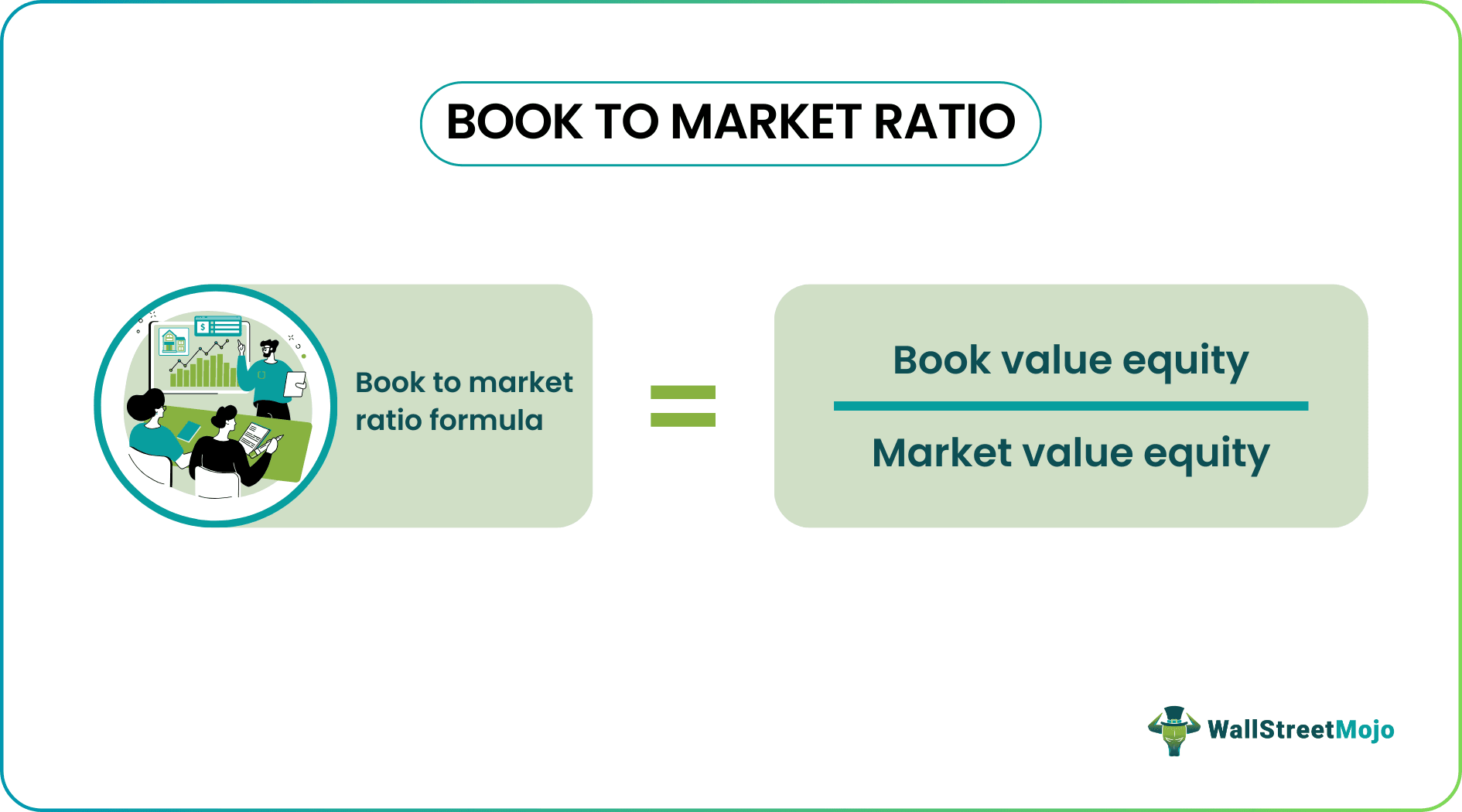

However, let us try to understand the formula that is commonly used to make the calculation of low or high book to market ratio. It is as given below:

Book to Market Ratio = Book Value of Equity / Market Value of Equity

where,

- Book value of equity = Based on accounting conventions

- The market value of equity = Market capitalization (Price * number of shares outstanding)

Example

Let us understand the concept of book to market ratio growth stock with the help of a suitable example.

XYZ Inc., a Nasdaq-listed company, is currently trading at $11.25 per share. The firm had a book value of assets of $110 million and a book value of liabilities of $65 million at the end of 2019. Based on the recent filing with the exchange and the SEC, the company has 4 million shares outstanding. As an analyst, determine of low or high book to market ratio for XYZ and, assuming everything is constant, interpret how the ratio influences investment decisions.

Solution

Use the below-given data for the calculation of positive or negative book to market ratio.

| Particulars | US ($) |

|---|---|

| Book Value of Assets | 110000000 |

| Book Value of Liabilities | 65000000 |

| Price Per Share | 11.25 |

| Number of Shares Outstanding | 4000000 |

Calculation of Book & Market Value of Equity

- = 110000000-65000000

- Book Value of Equity = 45000000

- = 11.25* 4000000

- Market Value of Equity = 45000000

The calculation can be done as follows,

- =45000000/45000000

- Book Value of Equity = 1.00

When a stock price falls to $10 -

- =45000000/40000000

- Book Value of Equity = 1.13

Calculation when a stock price increases to $20 can be done as follows,

- =45000000/80000000

- Book Value of Equity = 0.56

Interpretation

- In the original scenario, the stocks with high book to market ratio shows that the stock is fairly priced since the investors are willing to pay exactly what the net assets in the company are worth. If the stock price falls to $10 per share, the ratio increases to 1.13, which undervalues the stock, and other things stay constant. It is important to note that the book value of equity stays constant.

- The investors value the company at $40 million, while its net assets are worth $45 million. But it is not necessary that the stock is undervalued, and one should not jump to this conclusion. The market value is sensitive to investor expectations concerning future growth, company risk, expected payouts, etc. A lower growth expectation with low payouts or increased risk could justify this multiple.

- The investors value its net assets at $80 million, while its net assets are worth $45 million. If the stock price increases to $20 per share, the stocks with high book to market ratio falls to 0.56, overvaluing the stock. Other things stay constant.

- Usually, investors interpret this as a potential sign of correction with the price coming down, which again is sensitive to investor expectations concerning the fundamental variables. A higher growth expectation, a decrease in risk, and a higher expected payout ratio could justify this multiple and decrease the chances of a potential correction.

- Further, the book value is never readily available. For example, if an investor wanted the ratio on February 1, 2020, the latest book value for this date will not be available if this is not the end of a quarter of the financial year for the company. Another reason which renders this ratio to be less reliable in respect to how book value is determined. The book value normally ignores the fair value of intangible assets and the growth potential in the earnings, which leads to the risk of estimating a lower book value and hence, the ratio.