Table Of Contents

Net-Net Meaning

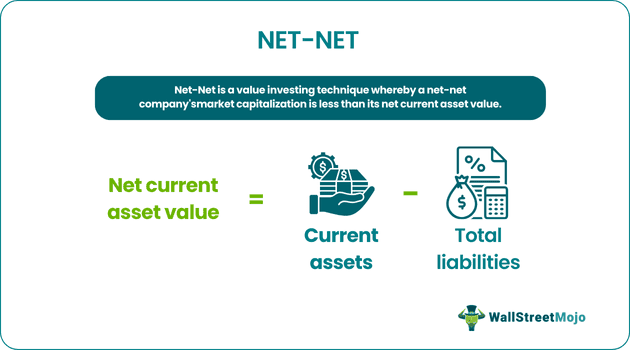

Net-net refers to a company trading at a very low price with its market capitalization more melancholy than its net current asset value (NCAV). Essentially, the technique is a conservative investing strategy focusing on acquiring stocks at a price lower than their liquidation value. In this process, the traders need to consider the net current assets of the company.

Economist Benjamin Graham is responsible for developing the net-net system at a time when information of any sort was not easily available; let alone financial information. Therefore, according to his theory, it was a commonly accepted norm that individuals could invest in companies with net-net asset value lesser than 67%.

Key Takeaways

- Net-net is a value investing concept introduced by Benjamin Graham, involving selecting stocks having market capitalization less than their net current asset value (NCAV). The NCAV is calculated by subtracting total liabilities from the current assets.

- Although such stocks are still present in the field, it is often hard to identify, and many use screeners.

- The impact of evolving business models and culture has reduced the effectiveness of this investing strategy.

How Does Net-Net Investing Work?

Net-net refers to the market capitalization of an organization whose difference is lesser than that between its assets and liabilities. However, in the equation of these net-net companies, their intangible assets and long-term assets such as plant, property, and equipment are beyond consideration.

Warren Buffet also advocated net-net investing as it was a popular strategy back in the day. Graham advocated purchasing stocks by considering their net current assets, overlooking long-term assets. According to this concept, if the NCAV of a company is greater than its market capitalization, it becomes a net-net stock.

Essentially, NCAV is a value calculated by subtracting the total current assets of a firm, such as cash and cash equivalents, adjusted inventory and receivables, etc., from total liability, including preferred stocks. The traders typically identify stocks as net-net when they trade below 2/3rd of the NCAV.

The strategy could seem helpful for investors with limited funds as the stocks are priced lower than their liquidation value. However, many experts have suggested that acquiring a handful of such stocks is fruitful when the companies' balance sheets are favorable. However, restricting the sales of such shares within 1-2 years is preferable to hedge against possible risks arising due to losses incurred by the firm.

Formula

Net current asset value and net working capital (NNWC) are the two formulas often referred to in this investment strategy. Let us understand both formulae to derive the numbers for net-net companies.

Net current asset value = Current assets - Total liabilities

Or

= Current assets – Total liabilities + Preferred Stock

It is important to take adjusted values of current assets by ignoring risky values for inventory and debtors' receivables. Doing so will give a more conservative and realistic picture of the organization.

Net-net working capital = - total liabilities

Additionally, traders also calculate the per-share value of NCAV and NNWC by dividing the respective values by the number of outstanding shares. So, the stock's per-share price must be 2/3 of the NCAVPS.

Examples

Let us understand this concept in detail with examples to derive the net-net asset value that is used as a metric for decision making

Example #1

ABC Inc. is a public company with total liabilities of $400 million, including preferred stock. The current assets equal $1,000 million. Calculate the company's net current asset value.

Net Current Assets Value (NCAV) = Current assets- Total Liabilities

- = $1000 - $400

- = $600

Example #2

For a specific year, ABC Inc.'s balance sheet revealed that the net current asset value per share is $9. So, should the investor buy the stock as part of the net-net investment approach?

NCAVPS = NCAV/Number of shares outstanding

NCAVPS = $9

Preferable purchase price = 2/3 x NCAVPS

= 2/3 x $9

= $6

Problems

At a press conference, Buffett once said that evolving business models and cultural changes have made this investing strategy less lucrative in the modern age. Moreover, there is difficulty finding net-net stocks in the current market due to improvised management activities like takeovers.

There are also some other factors contributing to the problems like;

- Focusing mainly on the quantitative aspect to pick cheap stocks

- Misrepresenting financial reports can mislead investors.

- A lousy business remains lousy throughout its lifespan

- Lacking competitive advantages

- Lacking ability as a long term investment

- Persistent requirements to collect a group of such company stocks and their net-net asset value as a method for them to work

- Inability to yield significant figures like wonderful businesses or growth stocks.

Is it Still Relevant?

During Graham's time, whenever businesses were liquidated, many companies preferred to ascribe the working capital to the shareholders' value. Therefore, the net-net approach was more practical than it is now. Today, closing a business usually attracts numerous costs which extract the working capital. However, it may still be viable if one is well-versed in the market and tries to make short-term gains. This is also a method of dispersing the risks that may arise when trading. On the other hand, finding net-net companies is extremely difficult, especially when the market trend is bullish.