Table Of Contents

What Is Exit Multiple?

Exit Multiple is a valuation metric used to gauge the attractiveness of an investment opportunity by comparing a company's enterprise value (EV) to a financial metric, typically earnings before interest, taxes, depreciation, and amortization (EBITDA). It indicates how many times the company's EBITDA an investor is willing to pay to acquire the company or its shares.

The exit multiple approach provides a quick and accessible way to evaluate a company's valuation and attractiveness. It aids investors in making investment decisions. However, it may oversimplify valuation and overlook key factors like cash flow, debt, and intangible assets. Additionally, it is sensitive to market fluctuations and may not provide an in-depth understanding of a company's actual value.

Key Takeaways

- Exit multiple is a metric that shows the perceived value of a company in the market and how much an investor is willing to pay to purchase the company or a share in its equity.

- Different industries can have different multiples as they are based on various factors such as financial performance, industry performance, risk profile, and growth potential.

- This metric makes it easy to compare valuation across different companies and industries by standardizing using EBITDA as the valuation metric.

- However, this metric may only be suitable for some industries or companies, especially those with irregular cash flows, unique business models, or significant intangible assets.

Exit Multiple Explained

Exit multiple refers to the ratio of a company's enterprise value (EV) to a financial metric, typically earnings before interest, taxes, depreciation, and amortization (EBITDA). This metric is used by investors and analysts to gauge the attractiveness of an investment opportunity and to estimate the potential return on investment.

The exit multiple method essentially represents how many times the company's EBITDA an investor is willing to pay to acquire the company or its shares. It serves as a measure of the company's perceived value in the market. A higher exit multiple indicates that investors are willing to pay a premium for the company, often reflecting expectations of strong future growth, market dominance, or other favorable factors.

Conversely, a lower exit multiple suggests that investors are less optimistic about the company's prospects or perceive higher risks associated with the investment. It could indicate factors such as industry downturns, poor financial performance, or increased competition.

These metrics are commonly used in valuation methods such as comparable company analysis (CCA) and precedent transactions analysis (PTA). In these methods, analysts identify similar companies or past transactions and use their exit multiples as benchmarks to estimate the value of the target company.

It is important to note that exit multiples can vary significantly across industries and companies, depending on factors such as growth potential, market dynamics, and risk profile. Therefore, thorough research and analysis are essential to determine an appropriate exit multiple for valuation purposes accurately.

Hence, exit multiple is a key metric used in investment analysis to evaluate the attractiveness of a company or investment opportunity. It provides insight into market sentiment, growth expectations, and perceived risks, helping investors make informed decisions.

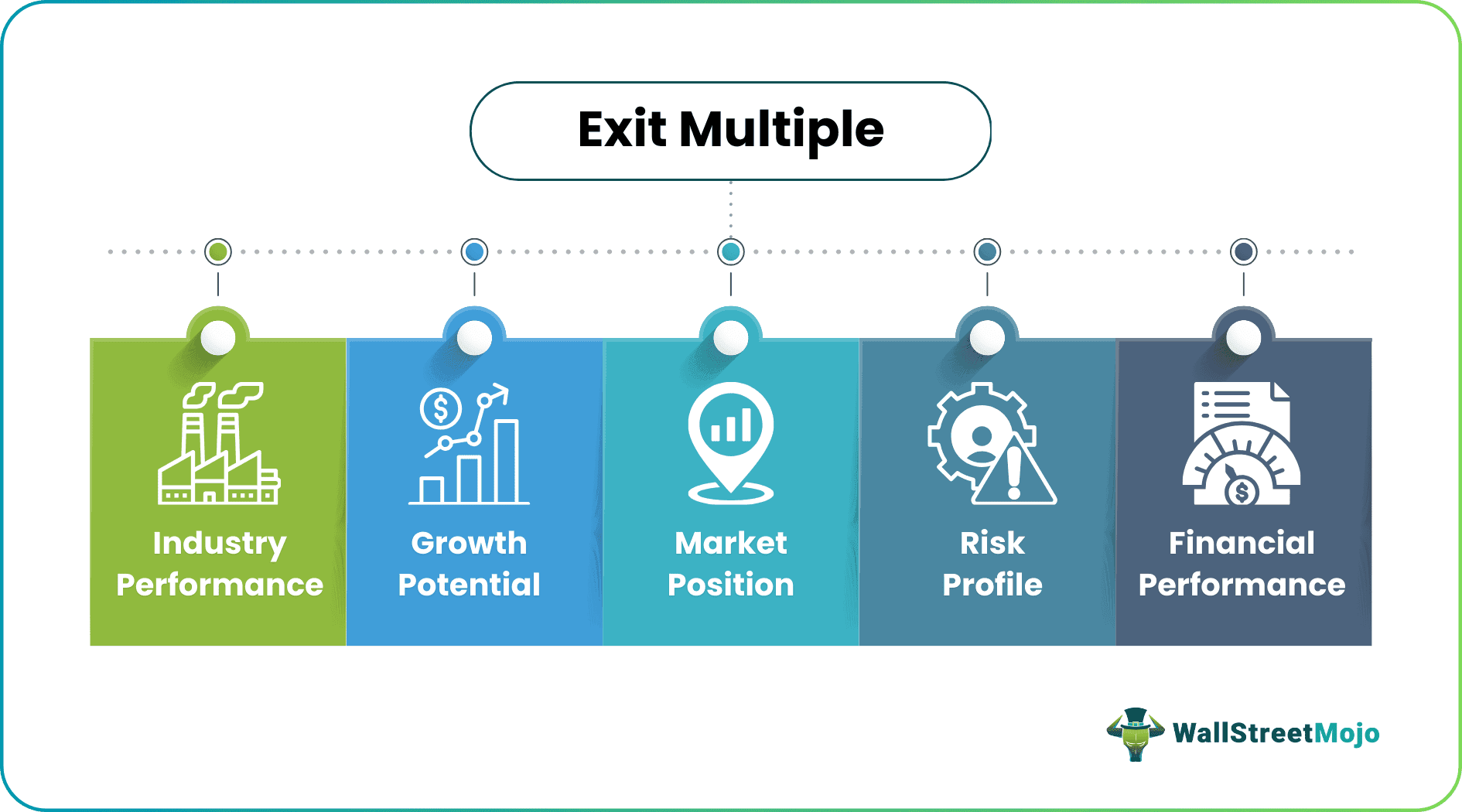

Factors

Multiple factors across industries play an essential role in determining the perceived value of the company in the market. Let us, therefore, understand the factors of the exit multiple approaches through the points below.

- Industry Performance: The overall performance and outlook of the industry can significantly impact exit multiples. Industries experiencing rapid growth or favorable market conditions tend to command higher multiples, while those facing challenges may have lower multiples.

- Company Growth Potential: Investors often pay higher multiples for companies with solid growth opportunities, innovative products or services, or a competitive advantage in the market. Positive revenue and earnings growth trajectories can lead to higher exit multiples.

- Market Position: Companies with a dominant market position, significant market share, or strong brand recognition typically attract higher exit multiples due to perceived stability and competitive advantage.

- Financial Performance: Consistent and healthy financial performance, including solid margins, revenue growth, and profitability, can lead to higher exit multiples. Conversely, poor financial metrics may result in lower multiples.

- Risk Profile: Investors assess various risks associated with the company, such as market risks, operational risks, and regulatory risks. Lower perceived risks often lead to higher exit multiples, while higher risks may result in lower multiples.

Formula

The formula for calculating exit multiple is relatively straightforward. It involves dividing the enterprise value (EV) of a company by a financial metric, typically EBITDA. Mathematically, the formula can be expressed as:

Exit Multiple = EV / EBITDA

Here,

- Enterprise value = The total value of a company, including its equity value, debt, and any other liabilities.

- EBITDA = It is a proxy for the company's operating performance before accounting for non-operating expenses.

How To Calculate?

Let us discuss the step-by-step process for investors and analysts to calculate the exit multiple and to assess the valuation and attractiveness of a company as an investment opportunity.

Step #1

Determine the Enterprise Value (EV) of the company. This involves adding the company's market capitalization, which is the total value of its outstanding shares, to its total debt, minority interest, and preferred shares while subtracting cash and cash equivalents.

Step #2

Obtain the EBITDA of the company. This can typically be found in the company's financial statements or calculated by adding back interest, taxes, depreciation, and amortization expenses to net income.

Step #3

Divide the EV by the EBITDA. This calculation yields the exit multiple, which indicates how many times the company's EBITDA an investor is willing to pay to acquire the company or its shares.

Step #4

Interpret the exit multiple. As mentioned earlier, a higher multiple suggests that investors are willing to pay a premium for the company. In contrast, a lower multiple may indicate lower investor confidence or perceived risks associated with the investment.

Examples

Now that the basics, factors, and formula of the exit multiple approach are clear, let us apply the theoretical knowledge to practical application through the examples below.

Example #1

LMN Inc. has an EV of $100 million and an EBITDA of $20 million. To calculate the exit multiple, one would divide the EV by the EBITDA, as discussed earlier. Let us do so to understand LMN's numbers.

So, using the formula, one gets:

Exit Multiple = EV / EBITDA

Exit Multiple = $100 million / $20 million = 5x

Since the industry's popularity is on the rise and the risk factors are well within permissible limits, it becomes an attractive investment. Therefore, investors are willing to pay five times the company's EBITDA to acquire XYZ Inc. or its shares.

Example #2

In June 2023, private equity investor LDC concluded its exit from creative and technology group MSQ after a successful four-year tenure, marked by five strategic acquisitions, at a commendable exit multiple of 3.9x. As a subsidiary of Lloyds Banking Group, LDC curated the sale to One Equity Partners, citing substantial growth in EBITDA from £6 million to over £20 million during its investment period.

LDC's initial investment in MSQ dates back to May 2019, initiating a collaborative effort with the management team to execute an efficient growth strategy, both organically and through acquisitions. This approach bore fruit, driving revenues upward from approximately £50 million to £125 million. Throughout 2019 to 2023, LDC facilitated MSQ's acquisition of five synergistic businesses, providing necessary follow-on funding. Noteworthy among these acquisitions was the £20.6 million public-to-private acquisition of the Be Heard Partnership, a milestone achievement realized in September 2020 despite the challenges posed by the global COVID-19 pandemic.

Advantages And Disadvantages

Most concepts or phenomena have factors from two extreme ends of the spectrum. The exit multiple approach is the same. Let us understand the advantages and disadvantages through the points below.

Advantages

- The exit multiple is a straightforward concept that is easy to understand and calculate, making it worthwhile to a wide range of investors and analysts.

- It allows for easy comparison of valuation across different companies and industries by standardizing the valuation metric, such as EBITDA, facilitating better investment decisions.

- This multiple reflects investors' perceptions of a company's value, incorporating factors such as growth prospects, market position, and risk profile. These factors provide valuable insights into market sentiment.

- A high exit multiple can signal optimism about future growth and profitability, providing a forward-looking perspective on the company's potential.

- Exit multiples are commonly employed in valuation methods like comparable company analysis (CCA) and precedent transactions analysis (PTA). These valuation methods enhance the reliability and efficiency of valuation models.

Disadvantages

- Exit multiples can be highly sensitive to market conditions, industry trends, and economic cycles. The sensitivity can lead to fluctuations in valuation that may not accurately reflect the underlying fundamentals of the company.

- The focus on EBITDA, the single metric, may need to be more accurate in the valuation process. This can overlook other important factors, such as cash flow, debt levels, and intangible assets, potentially leading to mispricing or undervaluation.

- Calculating this multiple involves making assumptions and estimates, which may vary among analysts and investors. The varying nature of assumptions might result in a lack of precision and consistency in valuation.

- The exit multiple needs to account for the timing of cash flows or the duration of the investment, which can impact the overall return on investment and may lead to misinterpretation of the company's value.

- While widely used, this metric may only be suitable for some industries or companies, particularly those with unique business models, irregular cash flows, or significant intangible assets, where alternative valuation methods may be more appropriate.

Exit Multiple vs Perpetuity Growth

Let us understand the distinctions between the two concepts through the comparison below.

Exit Multiple

- The exit multiple method is a relative valuation method that compares a company's value to a financial metric, typically EBITDA, of similar companies or past transactions.

- It reflects investors' assessment of a company's value based on its current financial performance and market sentiment.

- This metric provides insight into the company's value at a specific point in time, often focusing on short-term growth prospects and market conditions.

- It is widely used in investment analysis, particularly for calculating the attractiveness of an investment opportunity and estimating potential returns.

Perpetuity Growth

- Perpetuity growth, or Gordon Growth Model, is an absolute valuation method that estimates a company's value based on its projected future cash flows, discounted to present value.

- It considers the company's long-term growth potential, assuming stable growth rates indefinitely into the future.

- Perpetuity growth models provide a more long-term outlook on the company's value, emphasizing sustained growth and profitability.

- It is commonly used in discounted cash flow (DCF) analysis to express the intrinsic value of a company, particularly useful for companies with predictable cash flows and stable growth trajectories.