Table Of Contents

What Is First Chicago Method?

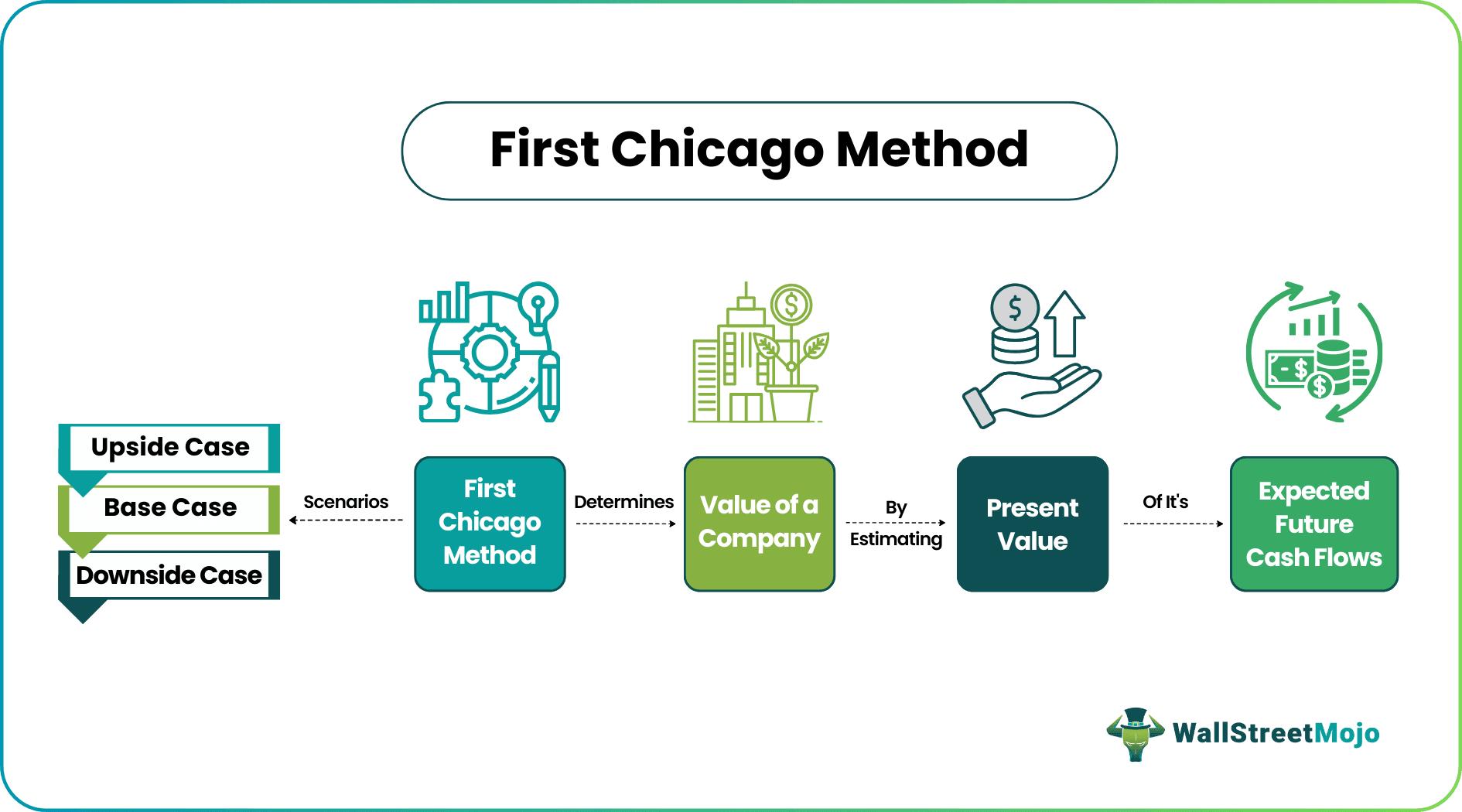

The First Chicago Method is an economic valuation method used in the field of corporate finance. The purpose of the First Chicago Method is to determine the value of a company by estimating the present value of its expected future cash flows.

The First Chicago Method, also known as the First Chicago School or First Chicago Approach. It was developed by economists Merton Miller and Franco Modigliani in the early 1950s. It considers the time value of money, risk factors, and the cost of capital to arrive at a valuation. This concept has significantly impacted the field of finance and corporate decision-making.

Key Takeaways

- The First Chicago Method is a valuation technique used to determine the financial worth of an investment or company by considering projected future cash flows and discounting them to their present values.

- The method recognizes that money received in the future is worth less than money received today, and it accounts for the time value of money by discounting future cash flows.

- The First Chicago Method incorporates the concept of risk by determining an appropriate discount rate based on the risk level associated with the investment.

First Chicago Method Explained

The First Chicago Method is a method used to arrive at the financial worth of an investment or company. It considers projected future cash flows and discounts them on their present values. It provides a framework for evaluating investment opportunities, assessing the worth of businesses, and determining the fair value of stocks and other financial instruments.

Considering future cash flows allows investors and analysts to make informed decisions regarding investments, mergers and acquisitions, and capital budgeting. The First Chicago Method remains a fundamental tool in corporate finance, helping to guide strategic financial planning and investment strategies.

It allows investors to assess the attractiveness of investment opportunities and make informed choices based on the expected returns. Moreover, this method plays a crucial role in mergers and acquisitions. It provides a basis for negotiating fair prices and evaluating potential synergies.

Scenarios

In the context of the First Chicago Method or Scenario Planning, the three different scenarios can be defined as the upside case, base case, and downside or worst-case scenario. These provide a range of possibilities for the organization to consider during the scenario planning process. They help understand the potential outcomes, develop strategies to capitalize on opportunities and build resilience to mitigate risks and uncertainties.

- Upside Case or Best-Case Scenario: The upside case represents an optimistic and favorable outlook for the organization. It outlines a future where all the key assumptions and factors work in the organization's favor. Economic conditions are robust, market demand is high, competition is manageable, and the organization achieves exceptional growth and success. This scenario often aligns with the business plan submitted by the organization, highlighting its desired outcomes and goals.

- Base Case: The base case scenario represents a realistic and expected future outcome based on a set of plausible assumptions. It is often considered the most likely or average scenario. The base case considers current market conditions, industry trends, and the organization's capabilities. It provides a foundation for planning and decision-making, considering the opportunities and challenges the organization will likely face. The base case scenario is a benchmark against which other scenarios are compared.

- The downside or Worst-Case Scenario: It explores a future where adverse events, unforeseen challenges, or unfavorable conditions impact the organization. It represents a scenario where key assumptions are unmet, and the organization faces significant difficulties. Economic downturns, disruptive technologies, intense competition, or regulatory constraints might be factors in this scenario. This scenario aims to identify vulnerabilities, potential risks, and the organization's ability to withstand and recover from adverse situations.

Steps

Let us look at the steps to understand the concept better.

- Estimate Future Cash Flows: Based on the available data and projections, estimate the future cash flows the company or investment is expected to generate over a specific period. Consider revenues, expenses, capital expenditures, and working capital requirements.

- Determine the Discount Rate: Calculate the appropriate discount rate for valuing the cash flows. The discount rate represents the required rate of return or the cost of capital associated with the investment. It considers the time value of money and the riskiness of the investment.

- Discount Cash Flows: Apply the discount rate to each projected cash flow to determine its present value. This involves dividing each cash flow by a factor that represents the appropriate discount rate and the period in which the cash flow is expected to be received.

- Sum the Present Values: Add the present values of all the projected cash flows to calculate the net present value (NPV). The NPV represents the value of the investment or the company based on the First Chicago Method. A positive NPV indicates that the investment is expected to generate more value than its cost, while a negative NPV suggests the opposite.

- Evaluate and Interpret the Results: Assess the NPV obtained from the valuation. A positive NPV indicates that the investment is potentially worthwhile, while a negative NPV suggests caution or a potential overvaluation. Consider other factors, such as risk assessments and market conditions, to make an informed decision or further refine the valuation.

Examples

Let us look at examples to understand the concept better.

Example #1

Suppose Company XYZ, a technology firm, seeks a valuation for a potential investment opportunity. Using the First Chicago Method, the analysts would start by estimating the anticipated future cash flows generated by the investment. They would consider factors such as expected revenues, operating expenses, capital expenditures, and working capital requirements over a specified period, say, five years.

Next, they would discount these projected cash flows to their present values, considering the time value of money and the company's cost of capital. The capital cost reflects the required return rate for investors, given the investment's risk profile.

After calculating the present values of the cash flows, the analysts would sum them up to determine the investment's net present value (NPV). A positive NPV would indicate that the investment is expected to generate more value than its cost. It makes it an attractive opportunity. Based on the NPV and other relevant factors, the analysts would provide a valuation for the investment, helping Company XYZ make an informed decision regarding the potential investment's viability and worth.

Example #2

Consider a manufacturing company called ABC Industries considering acquiring a competitor, XYZ Corp. ABC Industries wants to determine the fair value of XYZ Corp using this method to support its decision-making process.

ABC Industries' financial team would analyze XYZ Corp's historical financial data, industry trends, and growth prospects to begin the valuation process. They would then estimate the expected future cash flows of XYZ Corp, considering factors such as projected revenues, operating expenses, and potential synergies resulting from the acquisition.

The analysts would apply appropriate discount rates, considering the risk profile of XYZ Corp and the cost of capital of ABC Industries. By discounting the projected cash flows to their present values, they would calculate the potential acquisition's net present value (NPV).

If the NPV is positive, the acquisition will likely generate more value than its cost. It suggests it could be a financially beneficial opportunity for ABC Industries. Conversely, a negative NPV might suggest that the acquisition may not be economically viable.

Based on the valuation results, ABC Industries can decide whether to proceed with acquiring XYZ Corp.

Pros And Cons

Let us look at the pros of the First Chicago Method:

- Comprehensive Valuation: It provides a comprehensive approach to valuation by considering the projected future cash flows, discounting them to their present values, and incorporating the time value of money. This allows for a more accurate assessment of the financial worth of an investment or company.

- Consideration of Risk and Cost of Capital: The method incorporates the concept of risk by determining an appropriate discount rate based on the risk level associated with the investment. It also considers the cost of capital, ensuring that the valuation reflects the required rate of return.

- Applicability to Various Scenarios: It can be applied to various scenarios, such as investment evaluation, mergers and acquisitions, and strategic planning. Its flexibility allows for consistent and standardized valuation across different contexts.

Let us look at the cons of the First Chicago Method:

- Reliance on Projections: The accuracy of the valuation heavily depends on the accuracy and reliability of the projected cash flows. The valuation results may be skewed if the projections are overly optimistic or fail to account for potential risks and uncertainties.

- Sensitivity to Assumptions: The method relies on various assumptions, such as the discount rate, growth rates, and cash flow estimates. Small changes in these assumptions can significantly impact the valuation results, making them sensitive to subjective inputs.

- Lack of Consideration for Non-Financial Factors: It focuses primarily on financial factors and may not fully capture non-financial aspects that could affect the value of an investment or company, such as brand reputation, customer loyalty, or strategic advantages.

- Limited Application for Complex Scenarios: While this method provides a structured approach to valuation, it may not be suitable for complex situations. Like cases that involve intricate financial structures, unique business models, or non-traditional cash flow patterns.