Table Of Contents

What is Liquidation Value?

Liquidation value is the value of the assets that remain if the company goes out of business and is no longer a going concern; assets included in liquidation value include tangible assets like real estate, machinery, equipment, investment, etc., excluding the intangible assets.

Unlike human beings, a company is not a natural person. Its identity is different from that of its owners and managers. So, a death that seems to be inevitable for human beings is something that can be avoided from a company's point of view. Many companies go on for hundreds of years. However, even a company can shut down either on account of law (mostly on account of bankruptcy) or at the discretion of the management or the desire of the owners of the company.

Let us look at Fitbit’s share price movement over the past few quarters. We note that Fitbit stock plummeted by more than 90%. Does this mean Fitbit is now trading at an all-time low and is a buying opportunity? One way to perform a valuation check is to compare Fitbit’s share price with its Liquidation Value.

Is Fitbit trading below its liquidation value?

In this article, we discuss Liquidation value in detail -

Liquidation Value Definition

Liquidation is nothing but the process by which the company’s business is brought to an end, and the company is dissolved. All the assets which belong to the company are distributed amongst its creditors, lenders, shareholders, etc., based on seniority of claims.

Liquidation value is the total worth of a company’s tangible assets (physical assets) when it goes out of business. Tangible assets – fixed and current – are considered while calculating the company's liquidation value. However, intangible assets such as goodwill are not included in the same.

Video Explanation Of Liquidation Value

Book Value vs. Liquidation Value of an asset

Before understanding more about liquidation value, let us understand the meaning of "book value of assets". The asset's book value is the value at which the asset is carried on a balance sheet. It is arrived at by deducting total accumulated depreciation from the total cost of acquisition.

E.g., Company ABC purchases a piece of office furniture at the price of $ 1,00,000. Apart from the purchase price, they also end up paying the following expenses to bring the furniture to the required location:

- Loading & unloading charges - $ 1,000

- Interest charges to be paid on borrowed funds for buying furniture - $ 2,500

So total cost of acquisition will be $ 1,00,000 + $ 1,000 + $ 2,500 = $ 1,03,500

Depreciation on furniture (for the sake of convenience, let us say that the depreciation rate is 10% p.a. on the written down value)

- Year 1 = 10% * $ 1,03,500 = $ 10,350

- Year 2 = 10% * ($ 1,03,500 - $ 10,350) = $ 9,315

So, the book value of this piece of office furniture at the end of year 2 will be $ 1,03,500 – $ 10,350 – $ 9,315 = $ 83,835.

If we were to take the liquidation value of the above furniture, we would look more at the asset's market value rather than the book value of the asset. The current market price, which it can fetch at the end of 2 years, is $ 90,000, and this will be considered as the liquidation value and not $ 83,835, which is the asset's book value.

The simplest explanation for the above is that when a company is in the liquidation phase, it puts an end to its business and sells its assets to pay its debt. The selling price will be considered as the liquidation value and not the book value.

Salvage Value vs. Liquidation Value of an asset

There is something known as the "salvage value" of assets. It, again, is different from the liquidation value of the asset. The salvage value is the asset's estimated value at the end of the asset's useful life. At the time of liquidation, the asset may or may not have reached the end of its useful life, and it may fetch more than the salvage value.

E.g., The office furniture in the above example has a useful life of 10 years, after which its salvage value is expected to be $ 5000. But as clearly seen above, the market value is $ 90,000 for the given asset. It will be considered the liquidation value.

Liquidation Value Calculation of a Company

The above pointers help us understand the liquidation value of a single asset. In the simplest terms, liquidation value tells you the quantum which will be available to the shareholders if the company were to shut down in a very short period. On similar lines, let us now understand how to calculate the company's liquidation value as a whole.

The simplest way to find out this value is to go through the following steps:

Step 1 - Prepare the Balance Sheet of the company.

Prepare the company's balance sheet as per normal accounting policies as on the date on which you would like to find out the liquidation value.

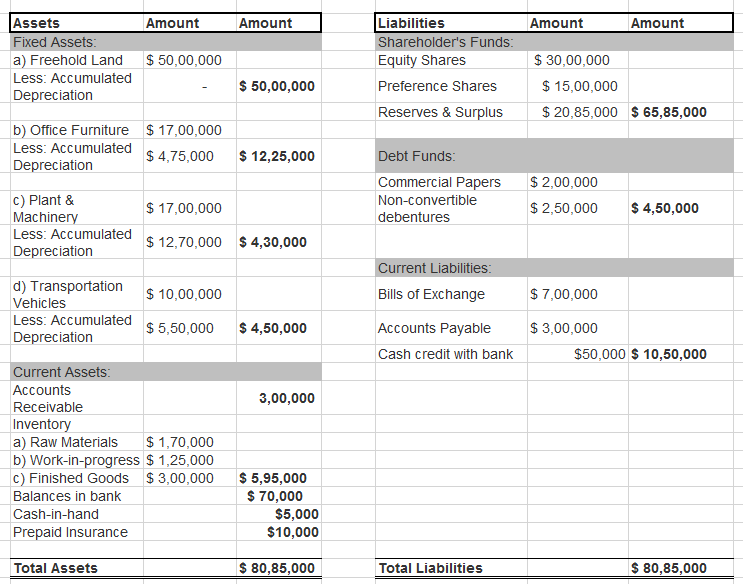

Following is the balance sheet of ABC Limited as of 31st December 2015:

Step 2 - Find the Market value of Tangible Assets.

Now, you take the company's tangible assets and find the market values of the same. At times, the purpose of finding the liquidation value may not necessarily be to wind up the company. It can be done for analysis purposes, as well. In this case, finding the market value for every asset may be inconvenient, and many companies resort to assigning a recovery percentage to each asset. It has to be as close to the market value as possible.

Some of the examples of recovery ratios are as follows:

- Cash and bank deposits will have a recovery of 100%

- Land owned by the company in a prime area may recover 150% as land prices generally appreciate in most developed/developing areas.

- Accounts receivables generally have a recovery percentage of around 65% to 70%. The business is coming to an end, and companies do get away by not paying small amounts in case of winding up.

Now coming back to the above example, let us apply the above pointers to figure out the recovery ratios for the assets:

| Assets | Amount | Recovery Ratio | Recovery Value | Comments |

|---|---|---|---|---|

| Fixed Assets | ||||

| Freehold Land | $ 50,00,000 | 150% | $ 75,00,000 | The value of land in the area has been appreciated since the company purchased it. The current property prices in the area suggest that we can earn a 50% profit over the original purchase price. Since there was no depreciation on freehold land, we have applied a flat recovery ratio of 150% of the book value. |

| Office Furniture | $ 12,25,000 | 50% | $ 6,12,500 | The company has found similar second-hand office furniture listed on e-commerce websites at this price. That is why the company assumes it can sell its furniture simultaneously. |

| Plant & Machinery | $ 4,30,000 | 25% | $ 1,07,500 | The machinery has been used on an overtime basis over the past years. The depreciated value itself is less, and the company expects that they will have to sell it for a value very close to its salvage value. |

| Transportation Vehicles | $ 4,50,000 | 75% | $ 3,37,500 | In this case, the company has spoken to a second-hand car dealer, and the rate is determined after consultation with them. |

| Total Fixed Assets | $ 71,05,000 | $ 85,57,500 | ||

| Current Assets | ||||

| Accounts Receivable | $ 3,00,000 | 75% | $ 2,25,000 | As mentioned earlier, small-timers don’t end up paying their debt if the company is going to liquidate, and they will never have to worry about their future orders with them. A conservative estimate is that they will be able to fetch 75% from its debtors. |

| Inventory | ||||

| a) Raw Materials | $ 1,70,000 | 90% | $ 1,53,000 | Raw material lying in the goods will fetch a good value as it is not a very aged inventory. So we can fairly assume that the fresh stock can be sold in the market at 100% of its value. |

| b) Work-in-progress | $ 1,25,000 | 5% | $6,250 | The company does not want to spend its time and resources completing the work-in-progress. It intends to sell the work-in-progress inventory as scrap, and the scrap value will fetch only 5% of the total value. |

| c) Finished Goods | $ 3,00,000 | 90% | $ 2,70,000 | Finished goods should fetch 100% but consider the time frame to liquidate the goods. The company might offer a discount, so the recovery ratio is assumed to be 90%. |

| Balances in bank | $ 70,000 | 100% | $ 70,000 | The bank balance is also liquid, and it will fetch 100%. However, at times there are charges for the closure of an account |

| Cash-in-hand | $ 5,000 | 100% | $ 5,000 | Cash is already liquid, and there is no point in applying a recovery ratio. |

| Prepaid Insurance | $ 10,000 | 0% | – | The company has already paid prepaid insurance for its stock, and on the closure of business, the insurance company will not pay back the premium. It is a kind of loss that the company will have to suffer, and hence the recovery ratio of 0% |

| Total Current Assets | $ 9,80,000 | $ 7,29,250 |

Since liquidation value does not take into account intangible assets; the market value of all intangible assets will be marked as 0. (Recovery ratio will be 0% in this case)

In the above example, there are no intangible assets like goodwill. But the company would have taken the recovery ratio as 0%, just like prepaid insurance.

Step 3 - Liquidation Value of Liabilities

Now, you need to subtract all liabilities from the total liquidation value of all assets. There is no point in calculating the market value of liabilities because, unlike assets, there will be no separate book value and market value. You will have to pay the entire amount reflected in the balance sheet.

Step 4 - Calculate Net Liquidation Value

The net amount derived from the amount will be the company's liquidation value, which will be available to the shareholders. There is a possibility (especially in the case of bankrupt companies) that the liquidation value may be negative, which means that the company does not have enough assets to repay its lenders. In this case, the lenders will be paid based on the priority of claims they hold on the company's assets.

Let us drill down the above example of ABC Limited to determine how to arrive at the final liquidation value for different stakeholders.

| Total Liquidation Value of Assets | $ 92,86,750 | |

| Less: Current Liabilities | $ 10,50,000 | |

| The amount available for Debt fund investors | $ 82,36,750 | In this case, the debt fund of the company is only $ 4,50,000, as opposed to the total $ 82,36,750 available as liquidation value. It is a very positive sign for the company because, in most cases, the company cannot even pay its current liabilities to the fullest extent. |

| Less: Amount outstanding towards Debt funds | $ 4,50,000 | |

| The amount available for Preference Shareholders | $ 77,86,750 | Again, the amount available for preference shareholders is more than the value of preference shares, which is just $ 15,00,000. So we pay them in full, and the net amount will be available to the equity shareholders. |

| Less: Amount outstanding towards Preference Shareholders | $ 15,00,000 | |

| The amount available for Equity Shareholders | $ 62,86,750 | As per the balance sheet, we need to add Reserves & Surplus to the total Equity Shares issued by the company to figure out the actual amount the shareholders should have ($ 50,85,000). In this case, the shareholders will get a profit over and above the reserves and surplus of the company. It is a dream come true for any shareholder. |

FITBIT's Example

Fitbit's stock has beaten in the last few quarters (as seen from the graph below).

In this example, we determine whether Fitbit is trading below its liquidation value.

source: ycharts

Step 1 - Download Fitbit's Balance Sheet.

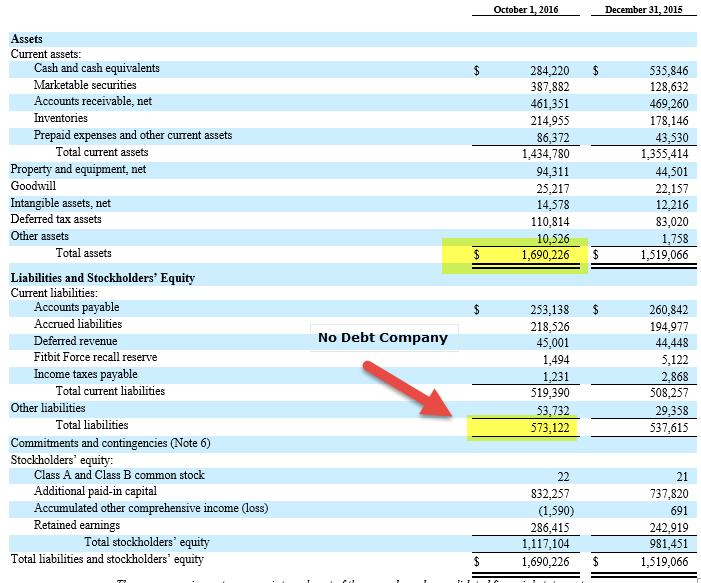

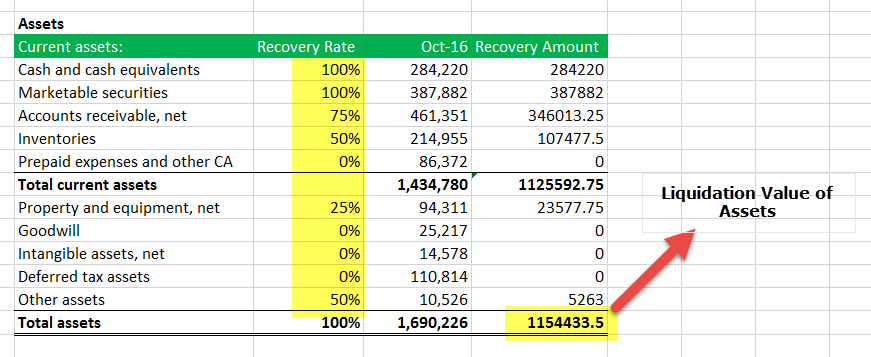

Step 2 - Find Liquidation Value of Fitbit's Assets

To find the liquidation value of Fitbit's assets, we assign a recovery rate to each class of assets. The reasons for the recovery rate were discussed in the earlier example.

- Cash and Cash equivalents and Marketable Securities are assigned a 100% recovery rate.

- Accounts Receivables is assigned a recovery rate of 75%

- Inventories are assigned a recovery of 50%

- Prepaid expenses are assigned a recovery of 0%

- Property Plant and equipment are assigned a recovery rate of 25%

- Other assets are assigned a recovery rate of 50%

- Goodwill, Intangible Assets, and Deferred Tax Assets are assigned a recovery rate of 0%

The total Liquidation value of Assets comes out to be $1,154,433 ('000)

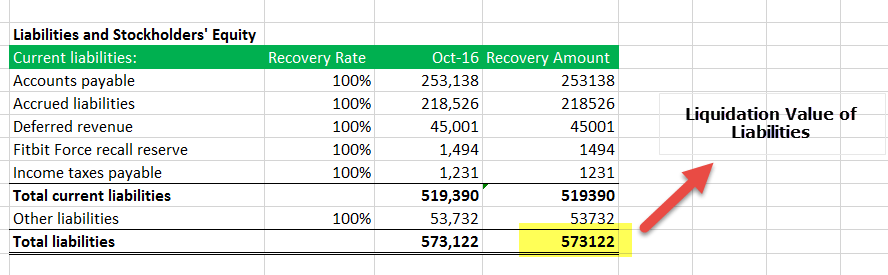

Step 3 - Find Liquidation Value of Fitbit's Liabilities

- We have assumed that all liabilities have to be paid out in full.

- Each type of liability is therefore assigned a recovery rate of 100%

Fitbit's Liabilities' total Liquidation value is $573,122 (‘000).

Please note that Fitbit does not have debt in its book.

Step 4 - Calculate Net Liquidation Value of Fitbit

- Net Liquidation Value Formula = Liquidation value of Assets - Liquidation value of Liabilities

- Net Liquidation Value of Fitbit = $1,154,433 ('000) - $573,122 ('000) = $581,312 ('000)

Step 5 - Find Per Share Liquidation Value of Fitbit

To find the per share liquidation value, we require the total number of shares outstanding.

We note that the total number of basic shares outstanding is 222,412 ('000)

source: Fitbit SEC Filings

Liquidation Value Per Share = $581,312 ('000) / 222,412 ('000) = 2.61x

Fitbit is trading at 2.61x of its liquidation value. It implies that Fitbit is trading very close to its liquidation value. If this stock falls further, then it will be a buy.

Using Tangible Book Value as a proxy

Tangible book value is calculated by subtracting all intangible assets like Goodwill, Patents, Copyrights, etc. from the Book Value of the firm.

- Tangible Book Value Formula = Book Value of Assets - Book Value of Liabilities - Intangible Assets

Let's compare the Tangible Book Value formula with the Liquidation Value formula.

- Liquidation Value Formula = Liquidation Value of Assets - Liquidation Value of Liabilities

While liquidation, the Liquidation value of Liabilities = Book Value of Liabilities.

So the formula above becomes,

- Liquidation Value Formula = Liquidation Value of Assets - Book Value of Liabilities

We are now calculating Liquidation Value of Assets = SUM (recovery rate of each asset x book value of assets).

In this formula, we assume that the recovery rate of Intangible Assets is 0%. It removes intangible assets from the liquidation value of Assets.

For other assets, the recovery rate is less than 100%, and therefore the Liquidation value of Assets is less than (Book value of Assets – Intangible Assets).

We note that even though the Liquidation value is less than the Tangible book value, it is a great proxy for identifying stocks that are trading close (below) the liquidation value.

Using the Price to tangible book value ratio provides a relative valuation multiple for making such a comparison.

- If the price to tangible book value is less than 1, then the share price is trading below its tangible book value. It implies that if the company is liquidated today, the shareholders will profit from higher tangible book value.

- If the price to tangible book value is greater than 1, the share price is trading above its tangible book value. It implies that if the company is liquidated today, the shareholders will be at a loss.

Let us pick some practical examples where Tangible Book Value (~Liquidation value) is greater than the Share Price.

Noble Corp Example

Take a look at Noble Corp Price to Tangible Book Value. Noble Corp owns and operates advanced fleets in the offshore drilling industry.

source: ycharts

Noble Corp's tangible book value was above 1.0x in 2012-2013. It resulted in a share decrease in Price to Tangible book value and is currently trading at 0.23x. Due to the commodities (Oil) slowdown, Noble Corp stock prices plummeted from a high of $32.50 in July 2013 to $6.87 currently.

source: ycharts

Transocean Example

Likewise, have a look at Transocean’s Price to Tangible Book Value. Transocean is an offshore drilling contractor and is based in Vernier, Switzerland.

source: ycharts

We note a similar trend in Transocean Price to Tangible Book value. In 2013, Transocean was trading at a price to tangible book value of 1.62x; however, it has sharply declined to 0.361x. Transocean is another example where the Liquidation value is greater than the Stock Price.

Let us now pick some other examples where the Liquidation value is negative.

Fiat Chrysler Example

Stocks with negative Liquidation Value imply that if these companies are liquidated today, the shareholders will not be able to recover their investments. Let us take Fiat Chrysler's example.

Fiat Chrysler’s price to book value is 0.966x; however, its Price to “tangible” book value is -2.08x. This implies that if Fiat Chrysler is to liquidate today, the shareholders will not recover their money (forgot about profiting from the investment).

source: ycharts